State Of Michigan Sales Tax Exemption Form - Siegers Seed Co.

ADVERTISEMENT

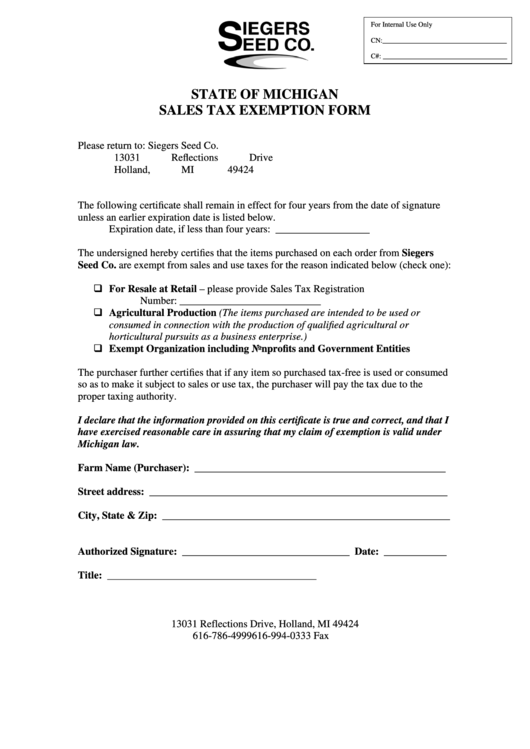

For Internal Use Only

CN:___________________________________

C#: ___________________________________

STATE OF MICHIGAN

SALES TAX EXEMPTION FORM

Please return to:

Siegers Seed Co.

13031 Reflections Drive

Holland, MI 49424

The following certificate shall remain in effect for four years from the date of signature

unless an earlier expiration date is listed below.

Expiration date, if less than four years: __________________

The undersigned hereby certifies that the items purchased on each order from Siegers

Seed Co. are exempt from sales and use taxes for the reason indicated below (check one):

For Resale at Retail – please provide Sales Tax Registration

Number: ___________________________

Agricultural Production (The items purchased are intended to be used or

consumed in connection with the production of qualified agricultural or

horticultural pursuits as a business enterprise.)

Exempt Organization including Nonprofits and Government Entities

The purchaser further certifies that if any item so purchased tax-free is used or consumed

so as to make it subject to sales or use tax, the purchaser will pay the tax due to the

proper taxing authority.

I declare that the information provided on this certificate is true and correct, and that I

have exercised reasonable care in assuring that my claim of exemption is valid under

Michigan law.

Farm Name (Purchaser): ________________________________________________

Street address: _________________________________________________________

City, State & Zip: _______________________________________________________

Authorized Signature: ________________________________ Date: ____________

Title: ________________________________________

13031 Reflections Drive, Holland, MI 49424

616-786-4999 616-994-0333 Fax

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1