Instructions For Form Ftb 3506

ADVERTISEMENT

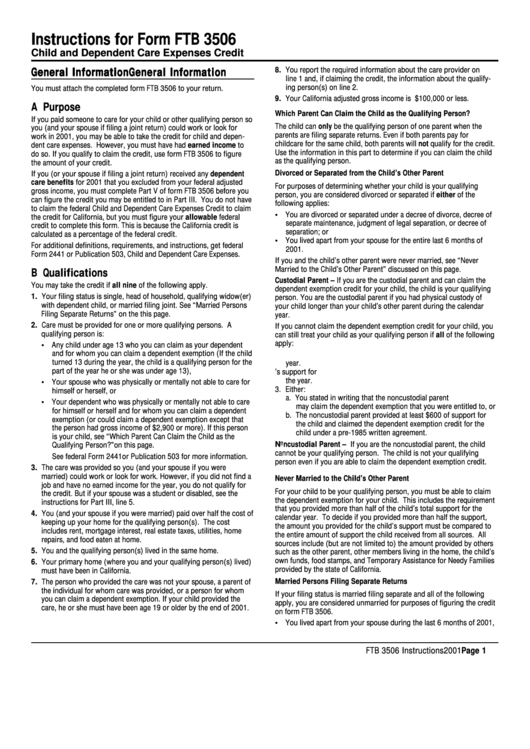

Instructions for Form FTB 3506

Child and Dependent Care Expenses Credit

8. You report the required information about the care provider on

General Information

General Information

General Information

General Information

General Information

line 1 and, if claiming the credit, the information about the qualify-

ing person(s) on line 2.

You must attach the completed form FTB 3506 to your return.

9. Your California adjusted gross income is $100,000 or less.

A Purpose

Which Parent Can Claim the Child as the Qualifying Person?

If you paid someone to care for your child or other qualifying person so

The child can only be the qualifying person of one parent when the

you (and your spouse if filing a joint return) could work or look for

parents are filing separate returns. Even if both parents pay for

work in 2001, you may be able to take the credit for child and depen-

childcare for the same child, both parents will not qualify for the credit.

dent care expenses. However, you must have had earned income to

Use the information in this part to determine if you can claim the child

do so. If you qualify to claim the credit, use form FTB 3506 to figure

as the qualifying person.

the amount of your credit.

Divorced or Separated from the Child’s Other Parent

If you (or your spouse if filing a joint return) received any dependent

care benefits for 2001 that you excluded from your federal adjusted

For purposes of determining whether your child is your qualifying

gross income, you must complete Part V of form FTB 3506 before you

person, you are considered divorced or separated if either of the

can figure the credit you may be entitled to in Part III. You do not have

following applies:

to claim the federal Child and Dependent Care Expenses Credit to claim

• You are divorced or separated under a decree of divorce, decree of

the credit for California, but you must figure your allowable federal

separate maintenance, judgment of legal separation, or decree of

credit to complete this form. This is because the California credit is

separation; or

calculated as a percentage of the federal credit.

• You lived apart from your spouse for the entire last 6 months of

For additional definitions, requirements, and instructions, get federal

2001.

Form 2441 or Publication 503, Child and Dependent Care Expenses.

If you and the child’s other parent were never married, see “Never

Married to the Child’s Other Parent” discussed on this page.

B Qualifications

Custodial Parent – If you are the custodial parent and can claim the

You may take the credit if all nine of the following apply.

dependent exemption credit for your child, the child is your qualifying

1. Your filing status is single, head of household, qualifying widow(er)

person. You are the custodial parent if you had physical custody of

with dependent child, or married filing joint. See “Married Persons

your child longer than your child’s other parent during the calendar

Filing Separate Returns” on the this page.

year.

2. Care must be provided for one or more qualifying persons. A

If you cannot claim the dependent exemption credit for your child, you

qualifying person is:

can still treat your child as your qualifying person if all of the following

apply:

• Any child under age 13 who you can claim as your dependent

and for whom you can claim a dependent exemption (If the child

1. One or both parents had custody of the child for more than half the

turned 13 during the year, the child is a qualifying person for the

year.

part of the year he or she was under age 13),

2. One or both parents provided more than half the child’s support for

the year.

• Your spouse who was physically or mentally not able to care for

3. Either:

himself or herself, or

a. You stated in writing that the noncustodial parent

• Your dependent who was physically or mentally not able to care

may claim the dependent exemption that you were entitled to, or

for himself or herself and for whom you can claim a dependent

b. The noncustodial parent provided at least $600 of support for

exemption (or could claim a dependent exemption except that

the child and claimed the dependent exemption credit for the

the person had gross income of $2,900 or more). If this person

child under a pre-1985 written agreement.

is your child, see “Which Parent Can Claim the Child as the

Noncustodial Parent – If you are the noncustodial parent, the child

Qualifying Person?” on this page.

cannot be your qualifying person. The child is not your qualifying

See federal Form 2441or Publication 503 for more information.

person even if you are able to claim the dependent exemption credit.

3. The care was provided so you (and your spouse if you were

married) could work or look for work. However, if you did not find a

Never Married to the Child’s Other Parent

job and have no earned income for the year, you do not qualify for

For your child to be your qualifying person, you must be able to claim

the credit. But if your spouse was a student or disabled, see the

the dependent exemption for your child. This includes the requirement

instructions for Part III, line 5.

that you provided more than half of the child’s total support for the

4. You (and your spouse if you were married) paid over half the cost of

calendar year. To decide if you provided more than half the support,

keeping up your home for the qualifying person(s). The cost

the amount you provided for the child’s support must be compared to

includes rent, mortgage interest, real estate taxes, utilities, home

the entire amount of support the child received from all sources. All

repairs, and food eaten at home.

sources include (but are not limited to) the amount provided by others

5. You and the qualifying person(s) lived in the same home.

such as the other parent, other members living in the home, the child’s

own funds, food stamps, and Temporary Assistance for Needy Families

6. Your primary home (where you and your qualifying person(s) lived)

provided by the state of California.

must have been in California.

Married Persons Filing Separate Returns

7. The person who provided the care was not your spouse, a parent of

the individual for whom care was provided, or a person for whom

If your filing status is married filing separate and all of the following

you can claim a dependent exemption. If your child provided the

apply, you are considered unmarried for purposes of figuring the credit

care, he or she must have been age 19 or older by the end of 2001.

on form FTB 3506.

• You lived apart from your spouse during the last 6 months of 2001,

FTB 3506 Instructions 2001 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3