Form C 104a - Importation Of A Private Motor Vehicle Into The United Kingdom On Transfer Of Residence From Outside The European Community

ADVERTISEMENT

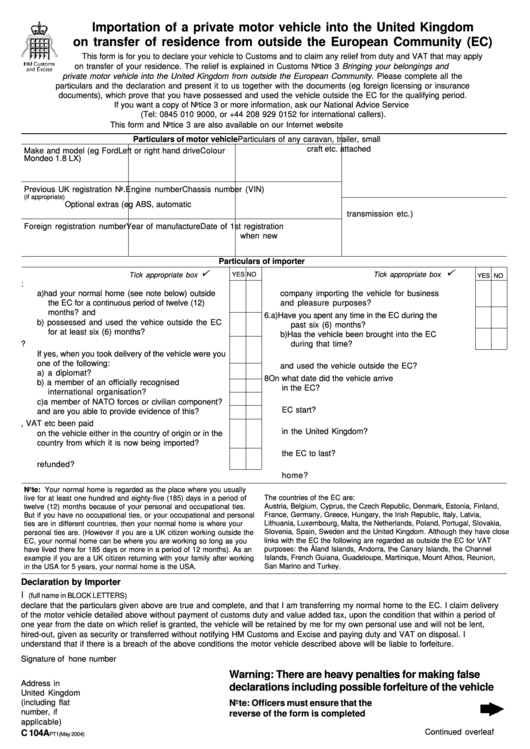

Importation of a private motor vehicle into the United Kingdom

on transfer of residence from outside the European Community (EC)

This form is for you to declare your vehicle to Customs and to claim any relief from duty and VAT that may apply

on transfer of your residence. The relief is explained in Customs Notice 3 Bringing your belongings and

private motor vehicle into the United Kingdom from outside the European Community. Please complete all the

particulars and the declaration and present it to us together with the documents (eg foreign licensing or insurance

documents), which prove that you have possessed and used the vehicle outside the EC for the qualifying period.

If you want a copy of Notice 3 or more information, ask our National Advice Service

(Tel: 0845 010 9000, or +44 208 929 0152 for international callers).

This form and Notice 3 are also available on our Internet website

Particulars of motor vehicle

Particulars of any caravan, trailer, small

craft etc. attached

Make and model (eg Ford

Left or right hand drive

Colour

Mondeo 1.8 LX)

Previous UK registration No. Engine number

Chassis number (VIN)

(if appropriate)

Optional extras (eg ABS, automatic

transmission etc.)

Foreign registration number Year of manufacture

Date of 1st registration

when new

Particulars of importer

ü

ü

YES NO

Tick appropriate box

Tick appropriate box

YES NO

1.

Have you:

5.

Are you a travelling sales representative for a

a) had your normal home (see note below) outside

company importing the vehicle for business

the EC for a continuous period of twelve (12)

and pleasure purposes?

months? and

6.

a) Have you spent any time in the EC during the

b) possessed and used the vehice outside the EC

past six (6) months?

for at least six (6) months?

b) Has the vehicle been brought into the EC

2.

Was the vehicle supplied tax free when new?

during that time?

If yes, when you took delivery of the vehicle were you

7.

From what date have you possessed

one of the following:

and used the vehicle outside the EC?

..................................

a) a diplomat?

8

On what date did the vehicle arrive

b) a member of an officially recognised

in the EC?

..................................

international organisation?

9.

On what date did your stay in the

c) a member of NATO forces or civilian component?

EC start?

..................................

and are you able to provide evidence of this?

10. On what date did the vehicle arrive

3.

Have all normal customs duties, VAT etc been paid

in the United Kingdom?

..................................

on the vehicle either in the country of origin or in the

country from which it is now being imported?

11. How long do you expect your stay in

the EC to last?

..................................

4.

Have these taxes been refunded or will they be

refunded?

12. Which EC country will be your

home?

..................................

Note: Your normal home is regarded as the place where you usually

The countries of the EC are:

live for at least one hundred and eighty-five (185) days in a period of

Austria, Belgium, Cyprus, the Czech Republic, Denmark, Estonia, Finland,

twelve (12) months because of your personal and occupational ties.

France, Germany, Greece, Hungary, the Irish Republic, Italy, Latvia,

But if you have no occupational ties, or your occupational and personal

Lithuania, Luxembourg, Malta, the Netherlands, Poland, Portugal, Slovakia,

ties are in different countries, then your normal home is where your

Slovenia, Spain, Sweden and the United Kingdom. Although they have close

personal ties are. (However if you are a UK citizen working outside the

links with the EC the following are regarded as outside the EC for VAT

EC, your normal home can be where you are working so long as you

purposes: the Åland Islands, Andorra, the Canary Islands, the Channel

have lived there for 185 days or more in a period of 12 months). As an

Islands, French Guiana, Guadeloupe, Martinique, Mount Athos, Reunion,

example if you are a UK citizen returning with your family after working

San Marino and Turkey.

in the USA for 5 years, your normal home is the USA.

Declaration by Importer

I ....................................................................................................................................................

(full name in BLOCK LETTERS)

declare that the particulars given above are true and complete, and that I am transferring my normal home to the EC. I claim delivery

of the motor vehicle detailed above without payment of customs duty and value added tax, upon the condition that within a period of

one year from the date on which relief is granted, the vehicle will be retained by me for my own personal use and will not be lent,

hired-out, given as security or transferred without notifying HM Customs and Excise and paying duty and VAT on disposal. I

understand that if there is a breach of the above conditions the motor vehicle described above will be liable to forfeiture.

Signature of importer ..................................................

Date ......................

United Kingdom telephone number

Warning: There are heavy penalties for making false

Address in the

..................................................

declarations including possible forfeiture of the vehicle

United Kingdom

(including flat

..................................................

Note: Officers must ensure that the

number, if

reverse of the form is completed

applicable)

..................................................

Continued overleaf

C 104A

PT1(May 2004)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2