PRINT

RESET

SAVE

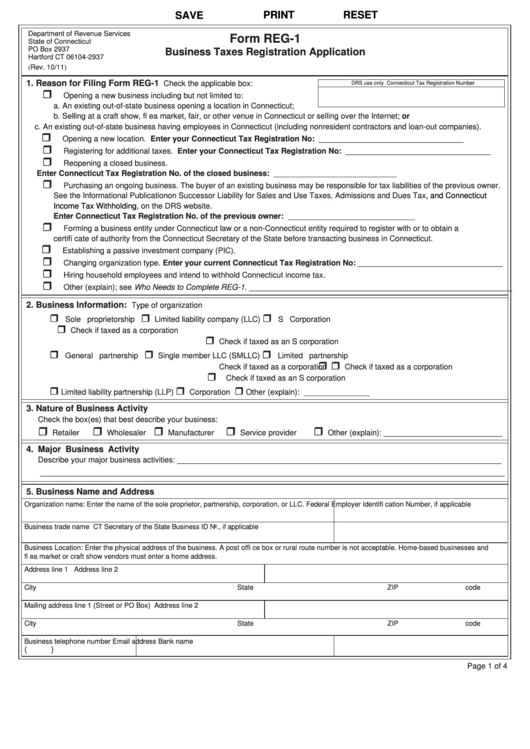

Department of Revenue Services

Form REG-1

State of Connecticut

PO Box 2937

Business Taxes Registration Application

Hartford CT 06104-2937

(Rev. 10/11)

1. Reason for Filing Form REG-1

Check the applicable box:

DRS use only Connecticut Tax Registration Number

Opening a new business including but not limited to:

a. An existing out-of-state business opening a location in Connecticut;

b. Selling at a craft show, fl ea market, fair, or other venue in Connecticut or selling over the Internet; or

c. An existing out-of-state business having employees in Connecticut (including nonresident contractors and loan-out companies).

Opening a new location. Enter your Connecticut Tax Registration No: _________________________________

Registering for additional taxes. Enter your Connecticut Tax Registration No: _________________________________

Reopening a closed business.

Enter Connecticut Tax Registration No. of the closed business: ____________________________

Purchasing an ongoing business. The buyer of an existing business may be responsible for tax liabilities of the previous owner.

See the Informational Publication on Successor Liability for Sales and Use

Taxes,

Admissions and Dues

Tax, and Connecticut

Income Tax

Withholding, on the DRS website.

Enter Connecticut Tax Registration No. of the previous owner: _____________________________

Forming a business entity under Connecticut law or a non-Connecticut entity required to register with or to obtain a

certifi cate of authority from the Connecticut Secretary of the State before transacting business in Connecticut.

Establishing a passive investment company (PIC).

Changing organization type. Enter your current Connecticut Tax Registration No: _________________________________

Hiring household employees and intend to withhold Connecticut income tax.

Other (explain); see Who Needs to Complete REG-1. ____________________________________________________________

2. Business Information:

Type of organization

Sole proprietorship

Limited liability company (LLC)

S Corporation

Check if taxed as a corporation

Check if taxed as an S corporation

General partnership

Single member LLC (SMLLC)

Limited partnership

Check if taxed as a corporation

Check if taxed as a corporation

Check if taxed as an S corporation

Limited liability partnership (LLP)

Corporation

Other (explain): _______________

3. Nature of Business Activity

Check the box(es) that best describe your business:

Retailer

Wholesaler

Manufacturer

Service provider

Other (explain): ___________________________

4. Major Business Activity

Describe your major business activities: __________________________________________________________________________

__________________________________________________________________________________________________________

5. Business Name and Address

Organization name: Enter the name of the sole proprietor, partnership, corporation, or LLC.

Federal Employer Identifi cation Number, if applicable

Business trade name

CT Secretary of the State Business ID No., if applicable

Business Location: Enter the physical address of the business. A post offi ce box or rural route number is not acceptable. Home-based businesses and

fl ea market or craft show vendors must enter a home address.

Address line 1

Address line 2

City

State

ZIP code

Mailing address line 1 (Street or PO Box)

Address line 2

City

State

ZIP code

Business telephone number

Email address

Bank name

(

)

Page 1 of 4

1

1 2

2 3

3 4

4