Simple Plan Checklist

ADVERTISEMENT

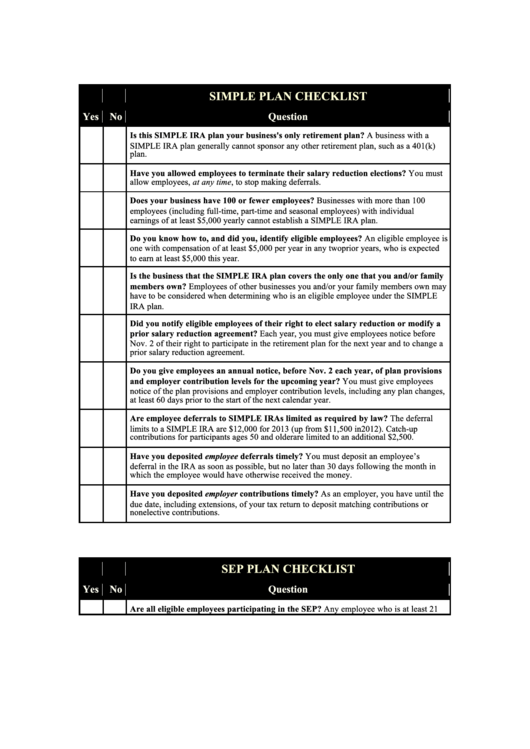

SIMPLE PLAN CHECKLIST

Yes No

Question

Is this SIMPLE IRA plan your business's only retirement plan? A business with a

SIMPLE IRA plan generally cannot sponsor any other retirement plan, such as a 401(k)

plan.

Have you allowed employees to terminate their salary reduction elections? You must

allow employees, at any time, to stop making deferrals.

Does your business have 100 or fewer employees? Businesses with more than 100

employees (including full-time, part-time and seasonal employees) with individual

earnings of at least $5,000 yearly cannot establish a SIMPLE IRA plan.

Do you know how to, and did you, identify eligible employees? An eligible employee is

one with compensation of at least $5,000 per year in any two prior years, who is expected

to earn at least $5,000 this year.

Is the business that the SIMPLE IRA plan covers the only one that you and/or family

members own? Employees of other businesses you and/or your family members own may

have to be considered when determining who is an eligible employee under the SIMPLE

IRA plan.

Did you notify eligible employees of their right to elect salary reduction or modify a

prior salary reduction agreement? Each year, you must give employees notice before

Nov. 2 of their right to participate in the retirement plan for the next year and to change a

prior salary reduction agreement.

Do you give employees an annual notice, before Nov. 2 each year, of plan provisions

and employer contribution levels for the upcoming year? You must give employees

notice of the plan provisions and employer contribution levels, including any plan changes,

at least 60 days prior to the start of the next calendar year.

Are employee deferrals to SIMPLE IRAs limited as required by law? The deferral

limits to a SIMPLE IRA are $12,000 for 2013 (up from $11,500 in 2012). Catch-up

contributions for participants ages 50 and older are limited to an additional $2,500.

Have you deposited employee deferrals timely? You must deposit an employee’s

deferral in the IRA as soon as possible, but no later than 30 days following the month in

which the employee would have otherwise received the money.

Have you deposited employer contributions timely? As an employer, you have until the

due date, including extensions, of your tax return to deposit matching contributions or

nonelective contributions.

SEP PLAN CHECKLIST

Yes No

Question

Are all eligible employees participating in the SEP? Any employee who is at least 21

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Life

1

1 2

2