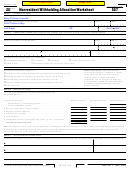

Form 587 Ca , 2009 Page 2

Download a blank fillable Form 587 Ca , 2009 in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 587 Ca , 2009 with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Instructions for Form 587

Nonresident Withholding Allocation Worksheet

References in these instructions are to the California Revenue and Taxation Code (R&TC).

General Information

to nonresidents of California for personal

Payments not subject to withholding

services performed in California and for

include payments:

Beginning January 1, 2008, domestic

rents and royalties on property located in

• To a resident of California or to a

nonresidents may use Form 589,

California . The withholding rate is seven

corporation with a permanent place of

Nonresident Request for Reduced

percent unless the FTB grants a waiver .

business in California .

Withholding, to request the reduction in

See General Information E, Waivers .

• To a corporation qualified to do

the standard seven percent withholding

business in California .

amount that is applicable to California

C When to File This Form

• To a partnership or LLC that has

source payments made to nonresidents .

a permanent place of business in

The withholding agent requests that the

Private Mail Box

California .

vendor/payee completes, signs, and

Include the Private Mail Box (PMB) in the

• For sale of goods .

returns Form 587 when a contract is

address field . Write “PMB” first, then the

• For income from intangible personal

entered into or before payment is made to

box number . Example: 111 Main Street

property, such as interest and

the vendor/payee .

PMB 123 .

dividends, unless the property has

Form 587 remains valid for the duration

acquired a business situs in California .

A Purpose

of the contract (or term of payments),

• For services performed outside of

provided there is no material change

Use Form 587, Nonresident Withholding

California .

in the facts . By signing Form 587, the

Allocation Worksheet, to determine if

• To a vendor/payee that is a tax-exempt

vendor/payee agrees to promptly notify

withholding is required on payments to

organization under either California or

the withholding agent of any changes in

nonresidents .

federal law .

the facts .

• Representing wages paid to employees .

The vendor/payee completes, signs, and

Wage withholding is administered

returns Form 587 to the withholding

D Withholding Requirements

by the California Employment

agent . The withholding agent relies on the

Development Department (EDD) . For

certification made by the vendor/payee

Payments made to nonresident

more information, contact your local

to determine if withholding is required,

vendors/payees (including individuals,

EDD office .

provided the completed and signed

corporations, partnerships, LLCs, estates,

• To reimburse a vendor/payee

Form 587 is accepted in good faith . Retain

and trusts) are subject to withholding .

for expenses relating to services

the completed Form 587 for your records,

However, no withholding is required

performed in California if the

and provide a copy to the Franchise Tax

if total payments of California source

reimbursement is separately accounted

Board (FTB) upon request .

income to the vendor/payee during the

for and not subject to federal

calendar year are $1,500 or less .

Do not use Form 587 if any of the

Form 1099 reporting . Corporate

following applies:

If the California resident, qualified

vendor/payees, for purposes of this

corporation, LLC, or partnership is

• Payment to a nonresident is only for

exception, are treated as individual

acting as an agent for the nonresident

the purchase of goods .

persons .

vendor/payee, the payment is subject to

• You sold California real estate . Use

withholding if the nonresident vendor/

Form 593-C, Real Estate Withholding

E Waivers

payee does not meet any of the exceptions

Certificate .

on Form 590 .

A nonresident vendor/payee may request

• The vendor/payee is a resident of

that withholding be waived . To apply

California or is a non-grantor trust that

Payments subject to withholding include

for a withholding waiver, use Form 588,

has at least one California resident

the following:

Nonresident Withholding Waiver Request .

trustee . Use Form 590, Withholding

• Payments for services performed in

If the FTB has granted a waiver, you must

Exemption Certificate .

California by nonresidents .

attach a copy of FTB’s determination letter

• The vendor/payee is a corporation,

• Payments made in connection with a

to Form 587 .

partnership, or limited liability

California performance .

company (LLC) that has a permanent

• Rent paid to nonresidents if the rent is

place of business in California or is

F Requirement to File a

paid in the course of the withholding

qualified to do business in California .

California Tax Return

agent’s business .

Use Form 590 .

• Royalties paid to nonresidents for the

A vendor’s/payee’s exemption

• The payment is to an estate and the

right to use natural resources located

certification on Form 587, Form 590,

decedent was a California resident . Use

in California .

or a determination letter from the FTB

Form 590 .

• Payments of prizes for contests

waiving withholding does not eliminate

entered in California .

the requirement to file a California tax

B Requirement

• Distributions of California source

return and pay the tax due . For return

income to nonresident beneficiaries

Revenue and Taxation Code (R&TC)

filing requirements, see the instructions

from an estate or trust .

Section 18662 and the related regulations

for Long or Short Form 540NR, California

• Other payments of California source

require withholding of income or

Nonresident or Part-Year Resident Income

income made to nonresidents .

franchise tax on certain payments made

Tax Return; Form 541, California Fiduciary

Form 587 Instructions 2008 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3