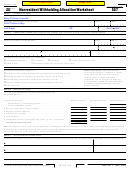

Form 587 Ca , 2009 Page 3

Download a blank fillable Form 587 Ca , 2009 in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 587 Ca , 2009 with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Income Tax Return; Form 100, California

In Person: Many libraries now have

when part of the services are performed

Corporation Franchise or Income

internet access . A nominal fee may apply

outside California, enter the amount paid

Tax Return; or Form 100S, California

to download, view, and print California

for performing services within California

S Corporation Franchise or Income

forms and publications . Employees at

in column (a) . Enter the amount paid

Tax Return .

libraries cannot provide tax information or

for performing services while outside

assistance .

California in column (b) . Enter the total

amount paid for services in column (c) .

G Where to get Publications,

Assistance for persons with disabilities

If the vendor’s/payee’s trade, business,

Forms, and Additional

We comply with the Americans with

or profession carried on in California

Disabilities Act . Persons with hearing or

Information

is an integral part of a unitary business

speech impairments call:

By Internet: You can download, view, and

carried on within and outside California,

TTY/TDD . . . . . . . . . . . . . . 800 .822 .6268

print California tax forms and publications

the amounts included on line 1 through

Asistencia para personas

from our website at ftb .ca .gov .

line 5 should be computed by applying the

discapacitadas . Nosotros estamos en

vendor’s/payee’s California apportionment

By Phone: To have publications or

conformidad con el Acta de Americanos

percentage (determined in accordance

forms mailed to you, or to get additional

Discapacitados . Personas con problemas

with the provisions of the Uniform

nonresident withholding information,

auditivos pueden llamar al TTY/TDD

Division of Income for Tax Purposes

contact Withholding Services and

800 .822 .6268 .

Act) to the payment amounts . For more

Compliance at the address or automated

information on apportionment, get

telephone number below:

Specific Instructions

California Schedule R, Apportionment and

WITHHOLDING SERVICES AND

Allocation of Income .

Part I – Withholding Agent

COMPLIANCE MS F182

Withholding agent . If the amount

FRANCHISE TAX BOARD

The withholding agent must complete

on line 6 is greater than $1,500, the

PO BOX 942867

Part I before giving Form 587 to the

withholding agent must withhold on all

SACRAMENTO CA 94267-0651

vendor/payee .

payments made to the vendor/payee until

Telephone: 888 .792 .4900

Part II – Nonresident Vendor/Payee

the entire amount on line 6 has been

916 .845 .4900

The vendor/payee must complete all

withheld upon . If circumstances change

(not toll-free)

information in Part II including the FEIN,

during the year (such as the total amount

Fax:

916 .845 .9512

social security number, or individual

of payments), which would change the

taxpayer identification number, and entity

amount on line 6, the vendor/payee must

type . No withholding is required if the

submit a new Form 587 to the withholding

H To Get Publications, Forms,

vendor/payee is a tax-exempt entity . Check

agent reflecting those changes . The

and Information Unrelated

the tax-exempt box if the vendor/payee is

withholding agent should evaluate the

to Nonresident Withholding

one of the following:

need for a new Form 587 when a change

in facts occurs .

By Automated Phone Service: Use this

• An entity that is exempt from tax under

service to check the status of your refund,

either California or federal law such as

Part V – Certification of Vendor/Payee

order California forms, obtain payment

a church, pension, or profit-sharing

Enter your name, title, and daytime

and balance due information, and hear

plan .

telephone number, including area code .

recorded answers to general questions .

• An insurance company, IRA .

Sign and date the form and return it to the

This service is available 24 hours a day,

• A federal, state, or local government

withholding agent .

7 days a week, in English and Spanish .

agency .

From within the

Tax-exempt vendors/payees do not need

United States . . . . . . . . . . 800 .338 .0505

to complete Part III and Part IV, but must

From outside the

complete Part V .

United States . . . . . . . . . . 916 .845 .6600

Part III – Payment Type

(not toll-free)

The nonresident vendor/payee must check

Follow the recorded instructions . Have

the box that identifies the type of payment

paper and pencil handy to take notes .

being received .

By Internet: You can download, view, and

No withholding is required when vendors/

print California tax forms and publications

payees are residents or have a permanent

from our website at ftb .ca .gov .

place of business in California .

By Mail: Allow two weeks to receive your

Part IV – Income Allocation

order . If you live outside of California,

allow three weeks to receive your order .

Use Part IV to identify payments that are

Write to:

subject to withholding . Only payments

sourced within California are subject

TAX FORMS REQUEST UNIT MS F284

to withholding . Services performed in

FRANCHISE TAX BOARD

California are sourced in California . In the

PO BOX 307

case of payments for services performed

RANCHO CORDOVA CA 95741-0307

Page 2 Form 587 Instructions 2008

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3