Employment Expense Checklist (Cra Form T2200)

ADVERTISEMENT

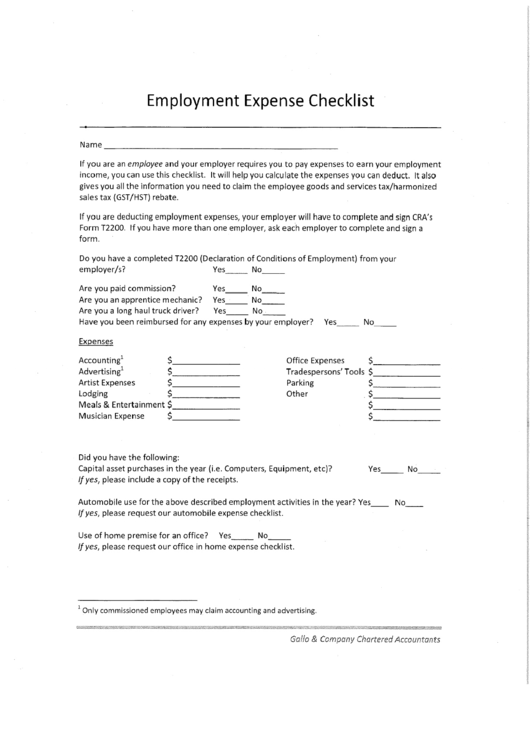

Employment Expense Checklist

Name

If you are an employee and your employer requires you to pay expenses to earn your employment

income, you can use this checklist. It will help you calculate the expenses you can deduct. It also

gives you all the information you need to claim the employee goods and services tax/harmonized

sales tax (GST/HST) rebate.

If you are deducting employment expenses, your employer will have to complete and sign CRA's

Form T2200. If you have more than one employer, ask each employer to complete and sign a

form.

Do you have a completed T2200 (Declaration of Conditions of Employment) from your

employer/s?

Yes

No

Are you paid commission?

Yes

No

Are you an apprentice mechanic? Yes

No

Are you a long haul truck driver?

Yes

No

Have you been reimbursed for any expenses by your employer? Yes

No

Expenses

Accounting'

$

Office Expenses

$

Advertising'

$

Tradespersons' Tools $

Artist Expenses

$

Parking

$

Lodging

$

Other

$

Meals & Entertainment $

$

Musician Expense

$

$

Did you have the following:

Capital asset purchases in the year (i.e. Computers, Equipment, etc)?

If yes, please include a copy of the receipts.

Automobile use for the above described employment activities in the year? Yes

No

If yes, please request our automobile expense checklist.

Use of home premise for an office? Yes

No

If yes, please request our office in home expense checklist.

1

Only commissioned employees may claim accounting and advertising.

SMEM!.

Gallo & Company Chartered Accountants

Yes

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Life

1

1