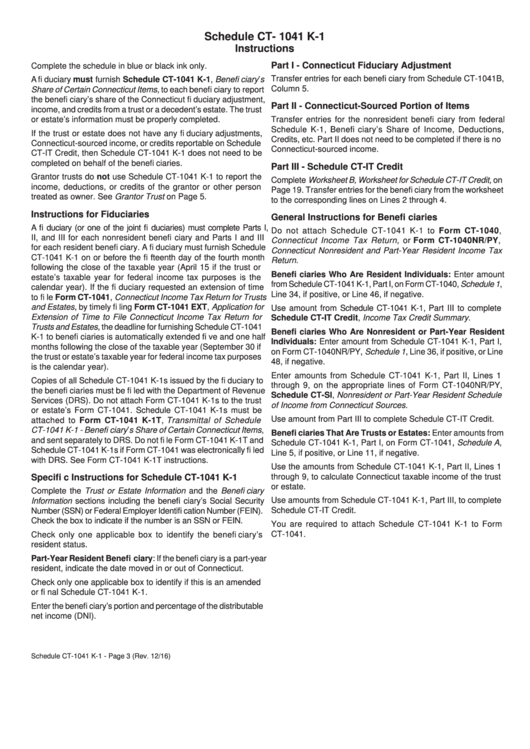

Schedule Ct-1041 K-1 Instructions

ADVERTISEMENT

Schedule CT- 1041 K-1

Instructions

Part I - Connecticut Fiduciary Adjustment

Complete the schedule in blue or black ink only.

Transfer entries for each benefi ciary from Schedule CT-1041B,

A fi duciary must furnish Schedule CT-1041 K-1, Benefi ciary’s

Column 5.

Share of Certain Connecticut Items, to each benefi ciary to report

the benefi ciary’s share of the Connecticut fi duciary adjustment,

Part II - Connecticut-Sourced Portion of Items

income, and credits from a trust or a decedent’s estate. The trust

or estate’s information must be properly completed.

Transfer entries for the nonresident benefi ciary from federal

Schedule K-1, Benefi ciary’s Share of Income, Deductions,

If the trust or estate does not have any fi duciary adjustments,

Credits, etc. Part II does not need to be completed if there is no

Connecticut-sourced income, or credits reportable on Schedule

Connecticut-sourced income.

CT-IT Credit, then Schedule CT-1041 K-1 does not need to be

completed on behalf of the benefi ciaries.

Part III - Schedule CT-IT Credit

Grantor trusts do not use Schedule CT-1041 K-1 to report the

Complete Worksheet B, Worksheet for Schedule CT-IT Credit, on

income, deductions, or credits of the grantor or other person

Page 19. Transfer entries for the benefi ciary from the worksheet

treated as owner. See Grantor Trust on Page 5.

to the corresponding lines on Lines 2 through 4.

Instructions for Fiduciaries

General Instructions for Benefi ciaries

A fi duciary (or one of the joint fi duciaries) must complete Parts I,

Do not attach Schedule CT-1041 K-1 to Form CT-1040,

II, and III for each nonresident benefi ciary and Parts I and III

Connecticut Income Tax Return, or Form CT-1040NR/PY,

for each resident benefi ciary. A fi duciary must furnish Schedule

Connecticut Nonresident and Part-Year Resident Income Tax

CT-1041 K-1 on or before the fi fteenth day of the fourth month

Return.

following the close of the taxable year (April 15 if the trust or

Benefi ciaries Who Are Resident Individuals: Enter amount

estate’s taxable year for federal income tax purposes is the

from Schedule CT-1041 K-1, Part I, on Form CT-1040, Schedule 1,

calendar year). If the fi duciary requested an extension of time

Line 34, if positive, or Line 46, if negative.

to fi le Form CT-1041, Connecticut Income Tax Return for Trusts

and Estates, by timely fi ling Form CT-1041 EXT, Application for

Use amount from Schedule CT-1041 K-1, Part III to complete

Extension of Time to File Connecticut Income Tax Return for

Schedule CT-IT Credit, Income Tax Credit Summary.

Trusts and Estates, the deadline for furnishing Schedule CT-1041

Benefi ciaries Who Are Nonresident or Part-Year Resident

K-1 to benefi ciaries is automatically extended fi ve and one half

Individuals: Enter amount from Schedule CT-1041 K-1, Part I,

months following the close of the taxable year (September 30 if

on Form CT-1040NR/PY, Schedule 1, Line 36, if positive, or Line

the trust or estate’s taxable year for federal income tax purposes

48, if negative.

is the calendar year).

Enter amounts from Schedule CT-1041 K-1, Part II, Lines 1

Copies of all Schedule CT-1041 K-1s issued by the fi duciary to

through 9, on the appropriate lines of Form CT-1040NR/PY,

the benefi ciaries must be fi led with the Department of Revenue

Schedule CT-SI, Nonresident or Part-Year Resident Schedule

Services (DRS). Do not attach Form CT-1041 K-1s to the trust

of Income from Connecticut Sources.

or estate’s Form CT-1041. Schedule CT-1041 K-1s must be

Use amount from Part III to complete Schedule CT-IT Credit.

attached to Form CT-1041 K-1T, Transmittal of Schedule

CT-1041 K-1 - Benefi ciary’s Share of Certain Connecticut Items,

Benefi ciaries That Are Trusts or Estates: Enter amounts from

and sent separately to DRS. Do not fi le Form CT-1041 K-1T and

Schedule CT-1041 K-1, Part I, on Form CT-1041, Schedule A,

Schedule CT-1041 K-1s if Form CT-1041 was electronically fi led

Line 5, if positive, or Line 11, if negative.

with DRS. See Form CT-1041 K-1T instructions.

Use the amounts from Schedule CT-1041 K-1, Part II, Lines 1

through 9, to calculate Connecticut taxable income of the trust

Specifi c Instructions for Schedule CT-1041 K-1

or estate.

Complete the Trust or Estate Information and the Benefi ciary

Use amounts from Schedule CT-1041 K-1, Part III, to complete

Information sections including the benefi ciary’s Social Security

Schedule CT-IT Credit.

Number (SSN) or Federal Employer Identifi cation Number (FEIN).

Check the box to indicate if the number is an SSN or FEIN.

You are required to attach Schedule CT-1041 K-1 to Form

CT-1041.

Check only one applicable box to identify the benefi ciary’s

resident status.

Part-Year Resident Benefi ciary: If the benefi ciary is a part-year

resident, indicate the date moved in or out of Connecticut.

Check only one applicable box to identify if this is an amended

or fi nal Schedule CT-1041 K-1.

Enter the benefi ciary’s portion and percentage of the distributable

net income (DNI).

Schedule CT-1041 K-1 - Page 3 (Rev. 12/16)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2