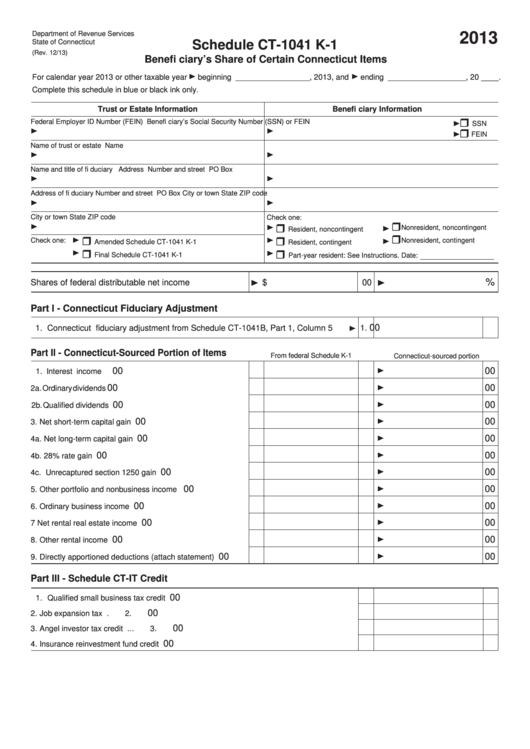

Department of Revenue Services

2013

State of Connecticut

Schedule CT-1041 K-1

(Rev. 12/13)

Benefi ciary’s Share of Certain Connecticut Items

For calendar year 2013 or other taxable year

beginning

, 2013, and

ending

, 20 ____.

___________________

____________________

Complete this schedule in blue or black ink only.

Trust or Estate Information

Benefi ciary Information

Federal Employer ID Number (FEIN)

Benefi ciary’s Social Security Number (SSN) or FEIN

SSN

FEIN

Name of trust or estate

Name

Name and title of fi duciary

Address

Number and street

PO Box

Address of fi duciary

Number and street

PO Box

City or town

State

ZIP code

City or town

State

ZIP code

Check one:

Resident, noncontingent

Nonresident, noncontingent

Check one:

Amended Schedule CT-1041 K-1

Resident, contingent

Nonresident, contingent

Final Schedule CT-1041 K-1

Part-year resident: See Instructions. Date:

%

Shares of federal distributable net income

$

00

Part I - Connecticut Fiduciary Adjustment

00

1. Connecticut fi duciary adjustment from Schedule CT-1041B, Part 1, Column 5 ........

1.

Part II - Connecticut-Sourced Portion of Items

From federal Schedule K-1

Connecticut-sourced portion

00

00

1. Interest income ........................................... ........................

1.

00

00

2a. Ordinary dividends ............................................................. 2a.

00

00

2b. Qualifi ed dividends ............................................................. 2b.

00

00

3. Net short-term capital gain .................................................

3.

00

00

4a. Net long-term capital gain .................................................. 4a.

00

00

4b. 28% rate gain ..................................................................... 4b.

00

00

4c. Unrecaptured section 1250 gain ........................................ 4c.

00

00

5. Other portfolio and nonbusiness income ...........................

5.

00

00

6. Ordinary business income ..................................................

6.

00

00

7 Net rental real estate income .............................................

7.

00

00

8. Other rental income ............................................................

8.

00

00

9. Directly apportioned deductions (attach statement) ...........

9.

Part III - Schedule CT-IT Credit

00

1. Qualifi ed small business tax credit ............................................................. ......................

1.

00

2. Job expansion tax credit....................................................................................................

2.

00

3. Angel investor tax credit ....................................................................................................

3.

00

4. Insurance reinvestment fund credit ...................................................................................

4.

1

1 2

2