Form Ct-1041 K-1t - Transmittal Of Schedule Ct-1041 K-1, Benefi Ciary'S Share Of Certain Connecticut Items - 2013

ADVERTISEMENT

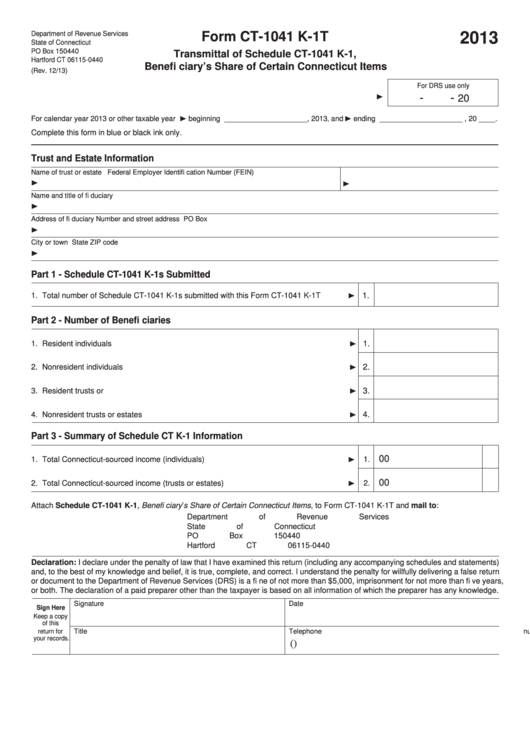

Department of Revenue Services

Form CT-1041 K-1T

2013

State of Connecticut

PO Box 150440

Transmittal of Schedule CT-1041 K-1,

Hartford CT 06115-0440

Benefi ciary’s Share of Certain Connecticut Items

(Rev. 12/13)

For DRS use only

-

-

20

For calendar year 2013 or other taxable year

beginning ____________________, 2013‚ and

ending ____________________ , 20 ____ .

Complete this form in blue or black ink only.

Trust and Estate Information

Name of trust or estate

Federal Employer Identifi cation Number (FEIN)

Name and title of fi duciary

Address of fi duciary

Number and street address

PO Box

City or town

State

ZIP code

Part 1 - Schedule CT-1041 K-1s Submitted

1.

1. Total number of Schedule CT-1041 K-1s submitted with this Form CT-1041 K-1T ............

Part 2 - Number of Benefi ciaries

1. Resident individuals ............................................................................................................

1.

2. Nonresident individuals .......................................................................................................

2.

3. Resident trusts or estates....................................................................................................

3.

4. Nonresident trusts or estates ...............................................................................................

4.

Part 3 - Summary of Schedule CT K-1 Information

00

1. Total Connecticut-sourced income (individuals) ..................................................................

1.

00

2. Total Connecticut-sourced income (trusts or estates) .........................................................

2.

Attach Schedule CT-1041 K-1, Benefi ciary’s Share of Certain Connecticut Items, to Form CT-1041 K-1T and mail to:

Department of Revenue Services

State of Connecticut

PO Box 150440

Hartford CT 06115-0440

Declaration: I declare under the penalty of law that I have examined this return (including any accompanying schedules and statements)

and, to the best of my knowledge and belief, it is true, complete, and correct. I understand the penalty for willfully delivering a false return

or document to the Department of Revenue Services (DRS) is a fi ne of not more than $5,000, imprisonment for not more than fi ve years,

or both. The declaration of a paid preparer other than the taxpayer is based on all information of which the preparer has any knowledge.

Signature

Date

Sign Here

Keep a copy

of this

return for

Title

Telephone number

your records.

(

)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2