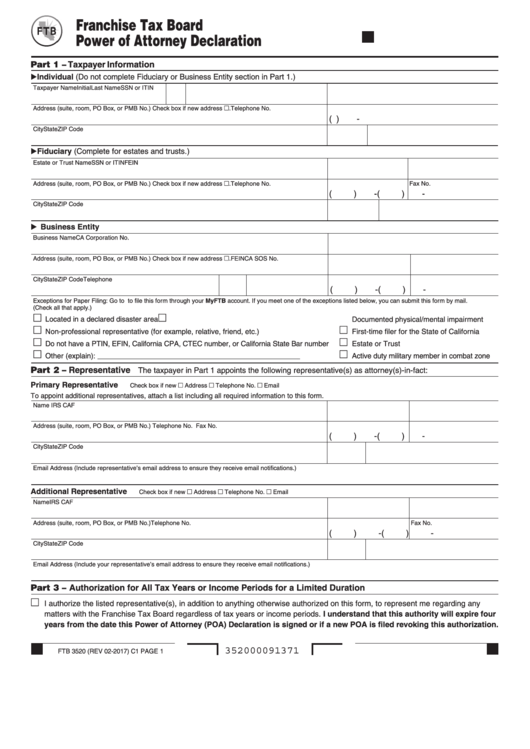

Franchise Tax Board

Power of Attorney Declaration

Part 1 – Taxpayer Information

Individual (Do not complete Fiduciary or Business Entity section in Part 1.)

Taxpayer Name

Initial Last Name

SSN or ITIN

Address (suite, room, PO Box, or PMB No.) Check box if new address .

Telephone No.

(

)

-

City

State

ZIP Code

Fiduciary (Complete for estates and trusts.)

Estate or Trust Name

SSN or ITIN

FEIN

Address (suite, room, PO Box, or PMB No.) Check box if new address .

Telephone No.

Fax No.

(

)

-

(

)

-

City

State

ZIP Code

Business Entity

Business Name

CA Corporation No.

Address (suite, room, PO Box, or PMB No.) Check box if new address .

FEIN

CA SOS No.

City

State

ZIP Code

Telephone No.

Fax No.

(

)

-

(

)

-

Exceptions for Paper Filing: Go to ftb.ca.gov to file this form through your MyFTB account. If you meet one of the exceptions listed below, you can submit this form by mail.

(Check all that apply.)

Located in a declared disaster area

Documented physical/mental impairment

Non-professional representative (for example, relative, friend, etc.)

First-time filer for the State of California

Do not have a PTIN, EFIN, California CPA, CTEC number, or California State Bar number

Estate or Trust

Other (explain):

Active duty military member in combat zone

Part 2 – Representative

The taxpayer in Part 1 appoints the following representative(s) as attorney(s)-in-fact:

Primary Representative

Check box if new Address Telephone No. Email

To appoint additional representatives, attach a list including all required information to this form.

Name

IRS CAF No.

PTIN

Address (suite, room, PO Box, or PMB No.)

Telephone No.

Fax No.

(

)

-

(

)

-

City

State

ZIP Code

Email Address (Include representative’s email address to ensure they receive email notifications.)

Additional Representative

Check box if new Address Telephone No. Email

Name

IRS CAF No.

PTIN

Address (suite, room, PO Box, or PMB No.)

Telephone No.

Fax No.

(

)

-

(

)

-

City

State

ZIP Code

Email Address (Include your representative’s email address to ensure they receive email notifications.)

Part 3 – Authorization for All Tax Years or Income Periods for a Limited Duration

I authorize the listed representative(s), in addition to anything otherwise authorized on this form, to represent me regarding any

matters with the Franchise Tax Board regardless of tax years or income periods. I understand that this authority will expire four

years from the date this Power of Attorney (POA) Declaration is signed or if a new POA is filed revoking this authorization.

352000091371

FTB 3520 (REV 02-2017) C1 PAGE 1

1

1 2

2