Motor Vehicle Usage Tax Multi-Purpose Form - Kentucky Department Of Revenue Page 2

ADVERTISEMENT

KRS 190.990(5) provides that any person who willfully and fraudulently submits a false statement as to the

total and actual consideration paid for a motor vehicle is guilty of a Class D felony and subject to a fine of not

less than $2,000 per offense.

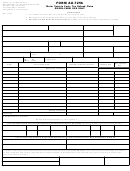

SECTION D

Complete this section for all transactions involving modified vehicles and those to which major equipment

has been added, if not using Form 71A100 and or TC 96-182. This form will not be accepted without proper

M

documentation (contract, bill of sale, front and back of cancelled check, etc.).

O

When using this form, taxable value of the modified, customized or converted vehicle shall not be less than the

D

retail value shown in the price reference manual for the vehicle without the modification.

I

F

I

Box/Flatbed

Bus/Limousine

E

Tank/Sprayer

Bucket/Lift/Cherry Picker

D

Packer/Garbage

Drill Body/Winch

Custom Truck/Van

Ambulance/Hearse

O

Dump/Mixer

Other*

R

Wrecker/Rollback

C

O

Purchase Price $_______________________

N

If “Other, ” specify _______________________________________ Revenue Code Number _______________________

V

E

*Those vehicles not listed in the prescribed reference manual, and those not modified, customized or

R

converted, must have a Revenue Code Number accompanying this form.

T

E

D

(Signature of Person Claiming Exemption)

(Date)

SECTION E

H

The portion of the retail price attributable to equipment or adaptive devices placed on new motor vehicles to

E

A

facilitate or accommodate handicapped persons is exempt from motor vehicle usage tax. Documentation of

Q

N

amount paid for such equipment or adaptive devices must be submitted with this certification.

U

D

I

I

P

Price Without Trade or Before Trade $ _________________________________________________________________

C

M

A

E

P

Portion of Price Attributable to Handicapped Equipment or Adaptive Devices $ __________________________

N

P

T

E

D

(Signature of Person Claiming Exemption)

(Date)

Please Note: For those vehicles whose values are not found in the prescribed price reference manuals,

contact the Motor Vehicle Usage Tax Section at (502) 564-4455.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2