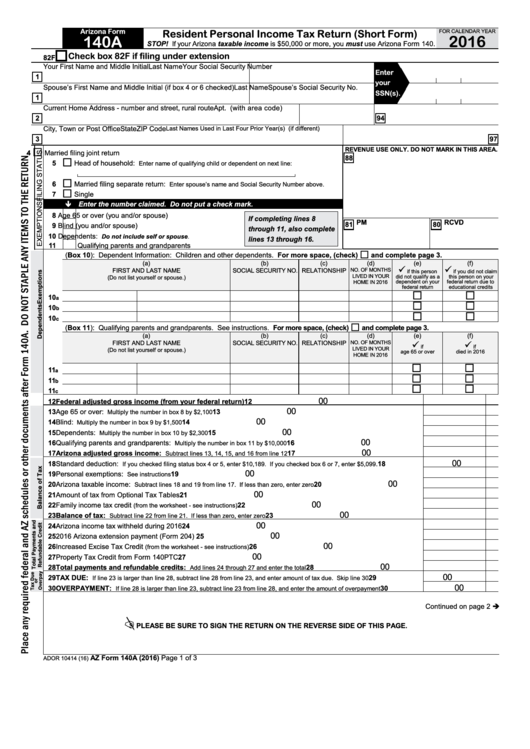

Arizona Form 140a - Resident Personal Income Tax Return - 2016

ADVERTISEMENT

Arizona Form

Resident Personal Income Tax Return (Short Form)

FOR CALENDAR YEAR

2016

140A

STOP! If your Arizona taxable income is $50,000 or more, you must use Arizona Form 140.

Check box 82F if filing under extension

82F

Your First Name and Middle Initial

Last Name

Your Social Security Number

Enter

1

your

Spouse’s First Name and Middle Initial (if box 4 or 6 checked)

Last Name

Spouse’s Social Security No.

SSN(s).

1

Current Home Address - number and street, rural route

Apt. No.

Daytime Phone (with area code)

2

94

City, Town or Post Office

State

ZIP Code

Last Names Used in Last Four Prior Year(s) (if different)

3

97

REVENUE USE ONLY. DO NOT MARK IN THIS AREA.

4

Married filing joint return

88

5

Head of household:

Enter name of qualifying child or dependent on next line:

6

Married filing separate return:

Enter spouse’s name and Social Security Number above.

7

Single

Enter the number claimed. Do not put a check mark.

8

Age 65 or over (you and/or spouse)

If completing lines 8

81 PM

80 RCVD

9

Blind (you and/or spouse)

through 11, also complete

10

Dependents:

Do not include self or spouse.

lines 13 through 16.

11

Qualifying parents and grandparents

(Box 10): Dependent Information: Children and other dependents. For more space, (check)

and complete page 3.

(a)

(b)

(c)

(d)

(e)

(f)

FIRST AND LAST NAME

SOCIAL SECURITY NO.

RELATIONSHIP

NO. OF MONTHS

if this person

if you did not claim

LIVED IN YOUR

did not qualify as a

this person on your

(Do not list yourself or spouse.)

dependent on your

federal return due to

HOME IN 2016

federal return

educational credits

10

a

10

b

10

c

(Box 11): Qualifying parents and grandparents. See instructions. For more space, (check)

and complete page 3.

(a)

(b)

(c)

(d)

(e)

(f)

NO. OF MONTHS

FIRST AND LAST NAME

SOCIAL SECURITY NO.

RELATIONSHIP

if

if

LIVED IN YOUR

(Do not list yourself or spouse.)

age 65 or over

died in 2016

HOME IN 2016

11

a

11

b

11

c

00

12 Federal adjusted gross income (from your federal return) ................................................................................... 12

00

13 Age 65 or over:

.................................................................................................... 13

Multiply the number in box 8 by $2,100

00

14 Blind:

.................................................................................................................... 14

Multiply the number in box 9 by $1,500

00

15 Dependents:

...................................................................................................... 15

Multiply the number in box 10 by $2,300

00

16 Qualifying parents and grandparents:

.............................................................. 16

Multiply the number in box 11 by $10,000

00

17 Arizona adjusted gross income:

............................................................. 17

Subtract lines 13, 14, 15, and 16 from line 12

00

18 Standard deduction:

. ............... 18

If you checked filing status box 4 or 5, enter $10,189. If you checked box 6 or 7, enter $5,099

00

19 Personal exemptions:

.......................................................................................................................... 19

See instructions

00

20 Arizona taxable income:

................................................ 20

Subtract lines 18 and 19 from line 17. If less than zero, enter zero

00

21 Amount of tax from Optional Tax Tables ...................................................................................................................... 21

00

22 Family income tax credit

....................................................................................... 22

(from the worksheet - see instructions)

00

23 Balance of tax:

......................................................................... 23

Subtract line 22 from line 21. If less than zero, enter zero

00

24 Arizona income tax withheld during 2016 .................................................................................................................... 24

00

25 2016 Arizona extension payment (Form 204).............................................................................................................. 25

00

26 Increased Excise Tax Credit

................................................................................. 26

(from the worksheet - see instructions)

00

27 Property Tax Credit from Form 140PTC ...................................................................................................................... 27

00

28 Total payments and refundable credits:

.................................................... 28

Add lines 24 through 27 and enter the total

00

29 TAX DUE:

.................... 29

If line 23 is larger than line 28, subtract line 28 from line 23, and enter amount of tax due. Skip line 30

00

30 OVERPAYMENT:

............... 30

If line 28 is larger than line 23, subtract line 23 from line 28, and enter the amount of overpayment

Continued on page 2

PLEASE BE SURE TO SIGN THE RETURN ON THE REVERSE SIDE OF THIS PAGE.

AZ Form 140A (2016)

Page 1 of 3

ADOR 10414 (16)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3