Blanket Exemption Certificate

ADVERTISEMENT

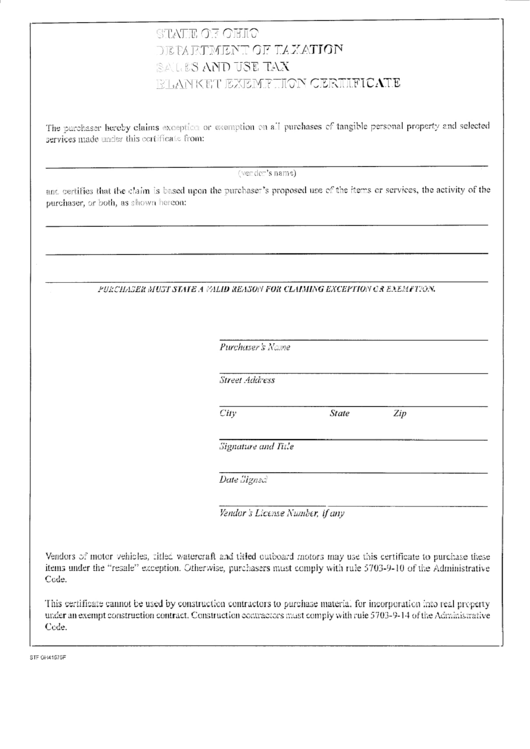

STATE OF OHIO

DEPARTMENT OF TAXATION

SALES AND USE TAX

BLANKET EXEMPTION CERTIFICATE

The purchaser hereby claims exception or exemption on all purchases of tangible personal property and selected

services made under this certificate from:

(vendor’s name)

and certifies that the claim is based upon the purchaser’s proposed use of the items or services, the activity of the

purchaser, or both, as shown hereon:

PURCHASER MUST STATE A VALID REASON FOR CLAIMING EXCEPTION OR EXEMPTION.

Purchaser ~Name

Street Address

City

State

Zip

Signature and Title

Date Signed

~f

Vendor s License Number

a ny

Vendors of motor vehicles, titled watercraft and titled outboard motors may use this certificate to purchase these

items under the “resale” exception. Otherwise, purchasers must comply with rule 5703-9-10 of the Administrative

Code.

This certificate cannot be used by construction contractors to purchase material for incorporation into real property

under an exempt construction contract. Construction contractors must comply with rule 5703-9-14 ofthe Administrative

Code.

STE 0H41 57SF

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2