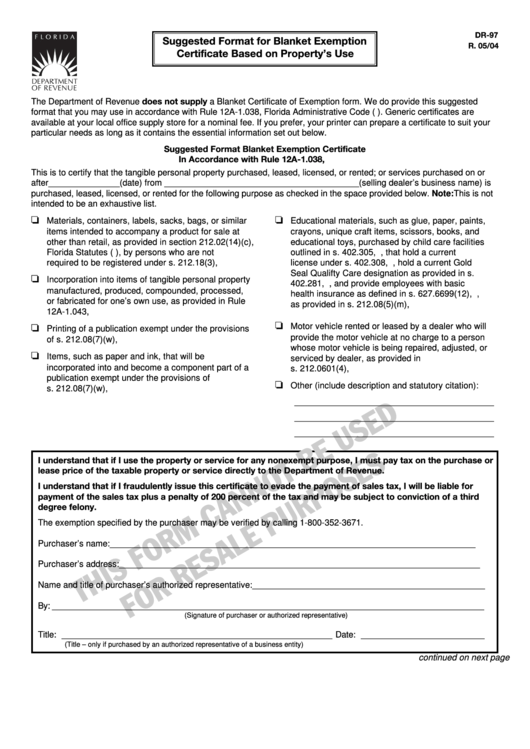

Form Dr-97 - Suggested Format For Blanket Exemption Certificate Based On Property'S Use

ADVERTISEMENT

DR-97

Suggested Format for Blanket Exemption

R. 05/04

Certificate Based on Property’s Use

The Department of Revenue does not supply a Blanket Certificate of Exemption form. We do provide this suggested

format that you may use in accordance with Rule 12A-1.038, Florida Administrative Code (F.A.C.). Generic certificates are

available at your local office supply store for a nominal fee. If you prefer, your printer can prepare a certificate to suit your

particular needs as long as it contains the essential information set out below.

Suggested Format Blanket Exemption Certificate

In Accordance with Rule 12A-1.038, F.A.C.

This is to certify that the tangible personal property purchased, leased, licensed, or rented; or services purchased on or

after_______________(date) from _________________________________________(selling dealer’s business name) is

purchased, leased, licensed, or rented for the following purpose as checked in the space provided below. Note: This is not

intended to be an exhaustive list.

Materials, containers, labels, sacks, bags, or similar

Educational materials, such as glue, paper, paints,

items intended to accompany a product for sale at

crayons, unique craft items, scissors, books, and

other than retail, as provided in section 212.02(14)(c),

educational toys, purchased by child care facilities

Florida Statutes (F.S.), by persons who are not

outlined in s. 402.305, F.S., that hold a current

required to be registered under s. 212.18(3), F.S.

license under s. 402.308, F.S., hold a current Gold

Seal Qualifty Care designation as provided in s.

Incorporation into items of tangible personal property

402.281, F.S., and provide employees with basic

manufactured, produced, compounded, processed,

health insurance as defined in s. 627.6699(12), F.S.,

or fabricated for one’s own use, as provided in Rule

as provided in s. 212.08(5)(m), F.S.

12A-1.043, F.A.C.

Motor vehicle rented or leased by a dealer who will

Printing of a publication exempt under the provisions

provide the motor vehicle at no charge to a person

of s. 212.08(7)(w), F.S.

whose motor vehicle is being repaired, adjusted, or

Items, such as paper and ink, that will be

serviced by dealer, as provided in

incorporated into and become a component part of a

s. 212.0601(4), F.S.

publication exempt under the provisions of

Other (include description and statutory citation):

s. 212.08(7)(w), F.S.

__________________________________________

__________________________________________

__________________________________________

I understand that if I use the property or service for any nonexempt purpose, I must pay tax on the purchase or

lease price of the taxable property or service directly to the Department of Revenue.

I understand that if I fraudulently issue this certificate to evade the payment of sales tax, I will be liable for

payment of the sales tax plus a penalty of 200 percent of the tax and may be subject to conviction of a third

degree felony.

The exemption specified by the purchaser may be verified by calling 1-800-352-3671.

Purchaser’s name: _____________________________________________________________________________

Purchaser’s address: ____________________________________________________________________________

Name and title of purchaser’s authorized representative: _________________________________________________

By: ___________________________________________________________________________________________

(Signature of purchaser or authorized representative)

Title: _________________________________________________________ Date: __________________________

(Title – only if purchased by an authorized representative of a business entity)

continued on next page

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1