Form R-1028 - Blanket Exemption Certificate For Purchases By Registered Wholesalers For Resale

ADVERTISEMENT

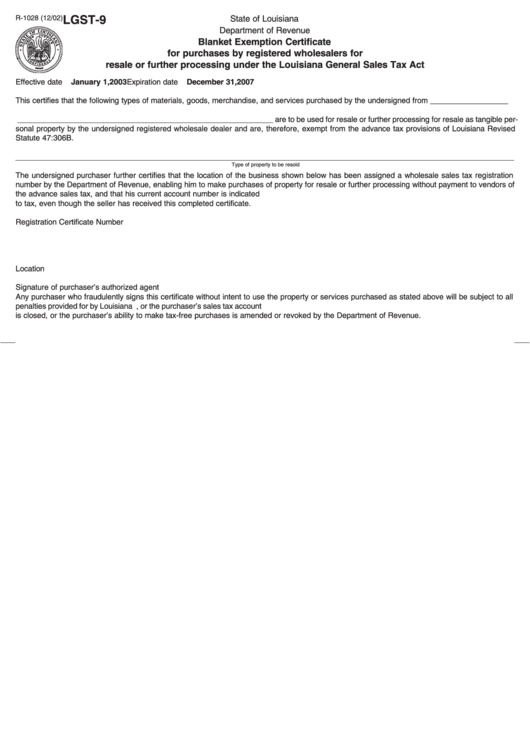

R-1028 (12/02)

State of Louisiana

LGST-9

Department of Revenue

Blanket Exemption Certificate

for purchases by registered wholesalers for

resale or further processing under the Louisiana General Sales Tax Act

Effective date

January 1, 2003

Expiration date

December 31, 2007

This certifies that the following types of materials, goods, merchandise, and services purchased by the undersigned from

__________________

___________________________________________________________ are to be used for resale or further processing for resale as tangible per-

sonal property by the undersigned registered wholesale dealer and are, therefore, exempt from the advance tax provisions of Louisiana Revised

Statute 47:306B.

Type of property to be resold

The undersigned purchaser further certifies that the location of the business shown below has been assigned a wholesale sales tax registration

number by the Department of Revenue, enabling him to make purchases of property for resale or further processing without payment to vendors of

the advance sales tax, and that his current account number is indicated above. The purchaser assumes full liability if the sale is later held subject

to tax, even though the seller has received this completed certificate.

Registration Certificate Number

Location

Signature of purchaser’s authorized agent

Any purchaser who fraudulently signs this certificate without intent to use the property or services purchased as stated above will be subject to all

penalties provided for by Louisiana statutes. This certificate will remain in effect until withdrawn by the purchaser, or the purchaser’s sales tax account

is closed, or the purchaser’s ability to make tax-free purchases is amended or revoked by the Department of Revenue.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1