Instructions For Form Ftb 3805p - Additional Taxes On Qualified Plans (Including Iras) And Other Tax-Favored Accounts - 2016

ADVERTISEMENT

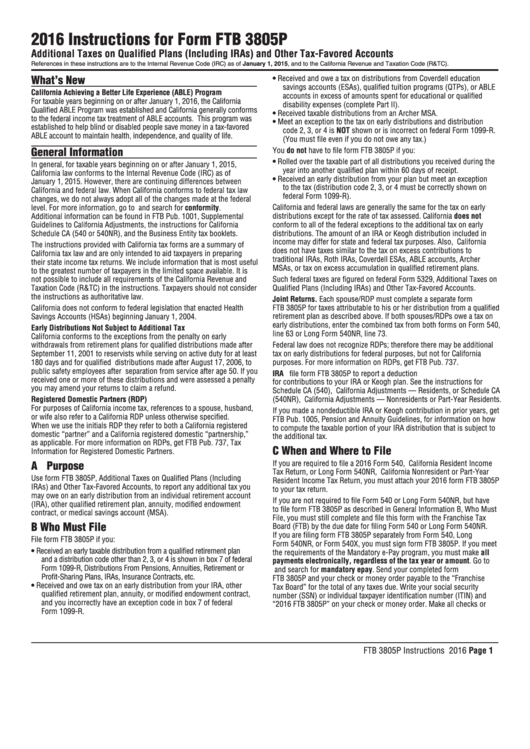

2016 Instructions for Form FTB 3805P

Additional Taxes on Qualified Plans (Including IRAs) and Other Tax-Favored Accounts

References in these instructions are to the Internal Revenue Code (IRC) as of January 1, 2015, and to the California Revenue and Taxation Code (R&TC).

What’s New

• Received and owe a tax on distributions from Coverdell education

savings accounts (ESAs), qualified tuition programs (QTPs), or ABLE

California Achieving a Better Life Experience (ABLE) Program

accounts in excess of amounts spent for educational or qualified

For taxable years beginning on or after January 1, 2016, the California

disability expenses (complete Part II).

Qualified ABLE Program was established and California generally conforms

• Received taxable distributions from an Archer MSA.

to the federal income tax treatment of ABLE accounts. This program was

• Meet an exception to the tax on early distributions and distribution

established to help blind or disabled people save money in a tax-favored

code 2, 3, or 4 is NOT shown or is incorrect on federal Form 1099-R.

ABLE account to maintain health, independence, and quality of life.

(You must file even if you do not owe any tax.)

General Information

You do not have to file form FTB 3805P if you:

• Rolled over the taxable part of all distributions you received during the

In general, for taxable years beginning on or after January 1, 2015,

year into another qualified plan within 60 days of receipt.

California law conforms to the Internal Revenue Code (IRC) as of

• Received an early distribution from your plan but meet an exception

January 1, 2015. However, there are continuing differences between

to the tax (distribution code 2, 3, or 4 must be correctly shown on

California and federal law. When California conforms to federal tax law

federal Form 1099-R).

changes, we do not always adopt all of the changes made at the federal

level. For more information, go to ftb.ca.gov and search for conformity.

California and federal laws are generally the same for the tax on early

Additional information can be found in FTB Pub. 1001, Supplemental

distributions except for the rate of tax assessed. California does not

Guidelines to California Adjustments, the instructions for California

conform to all of the federal exceptions to the additional tax on early

distributions. The amount of an IRA or Keogh distribution included in

Schedule CA (540 or 540NR), and the Business Entity tax booklets.

income may differ for state and federal tax purposes. Also, California

The instructions provided with California tax forms are a summary of

does not have taxes similar to the tax on excess contributions to

California tax law and are only intended to aid taxpayers in preparing

traditional IRAs, Roth IRAs, Coverdell ESAs, ABLE accounts, Archer

their state income tax returns. We include information that is most useful

MSAs, or tax on excess accumulation in qualified retirement plans.

to the greatest number of taxpayers in the limited space available. It is

not possible to include all requirements of the California Revenue and

Such federal taxes are figured on federal Form 5329, Additional Taxes on

Taxation Code (R&TC) in the instructions. Taxpayers should not consider

Qualified Plans (Including IRAs) and Other Tax-Favored Accounts.

the instructions as authoritative law.

Joint Returns. Each spouse/RDP must complete a separate form

California does not conform to federal legislation that enacted Health

FTB 3805P for taxes attributable to his or her distribution from a qualified

Savings Accounts (HSAs) beginning January 1, 2004.

retirement plan as described above. If both spouses/RDPs owe a tax on

early distributions, enter the combined tax from both forms on Form 540,

Early Distributions Not Subject to Additional Tax

line 63 or Long Form 540NR, line 73.

California conforms to the exceptions from the penalty on early

withdrawals from retirement plans for qualified distributions made after

Federal law does not recognize RDPs; therefore there may be additional

September 11, 2001 to reservists while serving on active duty for at least

tax on early distributions for federal purposes, but not for California

purposes. For more information on RDPs, get FTB Pub. 737.

180 days and for qualified distributions made after August 17, 2006, to

public safety employees after separation from service after age 50. If you

IRA Contributions. Do not file form FTB 3805P to report a deduction

received one or more of these distributions and were assessed a penalty

for contributions to your IRA or Keogh plan. See the instructions for

you may amend your returns to claim a refund.

Schedule CA (540), California Adjustments — Residents, or Schedule CA

(540NR), California Adjustments — Nonresidents or Part-Year Residents.

Registered Domestic Partners (RDP)

For purposes of California income tax, references to a spouse, husband,

If you made a nondeductible IRA or Keogh contribution in prior years, get

or wife also refer to a California RDP unless otherwise specified.

FTB Pub. 1005, Pension and Annuity Guidelines, for information on how

When we use the initials RDP they refer to both a California registered

to compute the taxable portion of your IRA distribution that is subject to

domestic “partner” and a California registered domestic “partnership,”

the additional tax.

as applicable. For more information on RDPs, get FTB Pub. 737, Tax

C When and Where to File

Information for Registered Domestic Partners.

A Purpose

If you are required to file a 2016 Form 540, California Resident Income

Tax Return, or Long Form 540NR, California Nonresident or Part-Year

Use form FTB 3805P, Additional Taxes on Qualified Plans (Including

Resident Income Tax Return, you must attach your 2016 form FTB 3805P

IRAs) and Other Tax-Favored Accounts, to report any additional tax you

to your tax return.

may owe on an early distribution from an individual retirement account

If you are not required to file Form 540 or Long Form 540NR, but have

(IRA), other qualified retirement plan, annuity, modified endowment

to file form FTB 3805P as described in General Information B, Who Must

contract, or medical savings account (MSA).

File, you must still complete and file this form with the Franchise Tax

B Who Must File

Board (FTB) by the due date for filing Form 540 or Long Form 540NR.

If you are filing form FTB 3805P separately from Form 540, Long

File form FTB 3805P if you:

Form 540NR, or Form 540X, you must sign form FTB 3805P. If you meet

• Received an early taxable distribution from a qualified retirement plan

the requirements of the Mandatory e-Pay program, you must make all

and a distribution code other than 2, 3, or 4 is shown in box 7 of federal

payments electronically, regardless of the tax year or amount. Go to

Form 1099-R, Distributions From Pensions, Annuities, Retirement or

ftb.ca.gov and search for mandatory epay. Send your completed form

Profit-Sharing Plans, IRAs, Insurance Contracts, etc.

FTB 3805P and your check or money order payable to the “Franchise

• Received and owe tax on an early distribution from your IRA, other

Tax Board” for the total of any taxes due. Write your social security

qualified retirement plan, annuity, or modified endowment contract,

number (SSN) or individual taxpayer identification number (ITIN) and

and you incorrectly have an exception code in box 7 of federal

“2016 FTB 3805P” on your check or money order. Make all checks or

Form 1099-R.

FTB 3805P Instructions 2016 Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4