Form 8820 - Orphan Drug Credit

Download a blank fillable Form 8820 - Orphan Drug Credit in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form 8820 - Orphan Drug Credit with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

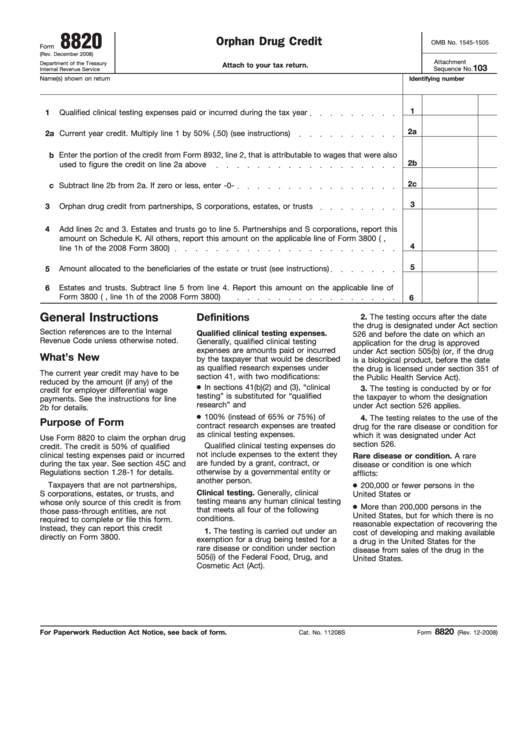

8820

Orphan Drug Credit

OMB No. 1545-1505

Form

(Rev. December 2008)

Attachment

Department of the Treasury

Attach to your tax return.

103

Sequence No.

Internal Revenue Service

Name(s) shown on return

Identifying number

1

1

Qualified clinical testing expenses paid or incurred during the tax year

2a

2a

Current year credit. Multiply line 1 by 50% (.50) (see instructions)

b Enter the portion of the credit from Form 8932, line 2, that is attributable to wages that were also

2b

used to figure the credit on line 2a above

2c

c Subtract line 2b from 2a. If zero or less, enter -0-

3

3

Orphan drug credit from partnerships, S corporations, estates, or trusts

4

Add lines 2c and 3. Estates and trusts go to line 5. Partnerships and S corporations, report this

amount on Schedule K. All others, report this amount on the applicable line of Form 3800 (e.g.,

4

line 1h of the 2008 Form 3800)

5

Amount allocated to the beneficiaries of the estate or trust (see instructions)

5

6

Estates and trusts. Subtract line 5 from line 4. Report this amount on the applicable line of

Form 3800 (e.g., line 1h of the 2008 Form 3800)

6

General Instructions

Definitions

2. The testing occurs after the date

the drug is designated under Act section

Section references are to the Internal

Qualified clinical testing expenses.

526 and before the date on which an

Revenue Code unless otherwise noted.

Generally, qualified clinical testing

application for the drug is approved

expenses are amounts paid or incurred

under Act section 505(b) (or, if the drug

What’s New

by the taxpayer that would be described

is a biological product, before the date

as qualified research expenses under

the drug is licensed under section 351 of

The current year credit may have to be

section 41, with two modifications:

the Public Health Service Act).

reduced by the amount (if any) of the

In sections 41(b)(2) and (3), “clinical

3. The testing is conducted by or for

credit for employer differential wage

testing” is substituted for “qualified

the taxpayer to whom the designation

payments. See the instructions for line

research” and

under Act section 526 applies.

2b for details.

100% (instead of 65% or 75%) of

4. The testing relates to the use of the

Purpose of Form

contract research expenses are treated

drug for the rare disease or condition for

as clinical testing expenses.

which it was designated under Act

Use Form 8820 to claim the orphan drug

section 526.

Qualified clinical testing expenses do

credit. The credit is 50% of qualified

not include expenses to the extent they

clinical testing expenses paid or incurred

Rare disease or condition. A rare

are funded by a grant, contract, or

during the tax year. See section 45C and

disease or condition is one which

otherwise by a governmental entity or

Regulations section 1.28-1 for details.

afflicts:

another person.

Taxpayers that are not partnerships,

200,000 or fewer persons in the

Clinical testing. Generally, clinical

S corporations, estates, or trusts, and

United States or

testing means any human clinical testing

whose only source of this credit is from

More than 200,000 persons in the

that meets all four of the following

those pass-through entities, are not

United States, but for which there is no

conditions.

required to complete or file this form.

reasonable expectation of recovering the

Instead, they can report this credit

1. The testing is carried out under an

cost of developing and making available

directly on Form 3800.

exemption for a drug being tested for a

a drug in the United States for the

rare disease or condition under section

disease from sales of the drug in the

505(i) of the Federal Food, Drug, and

United States.

Cosmetic Act (Act).

8820

For Paperwork Reduction Act Notice, see back of form.

Cat. No. 11208S

Form

(Rev. 12-2008)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2