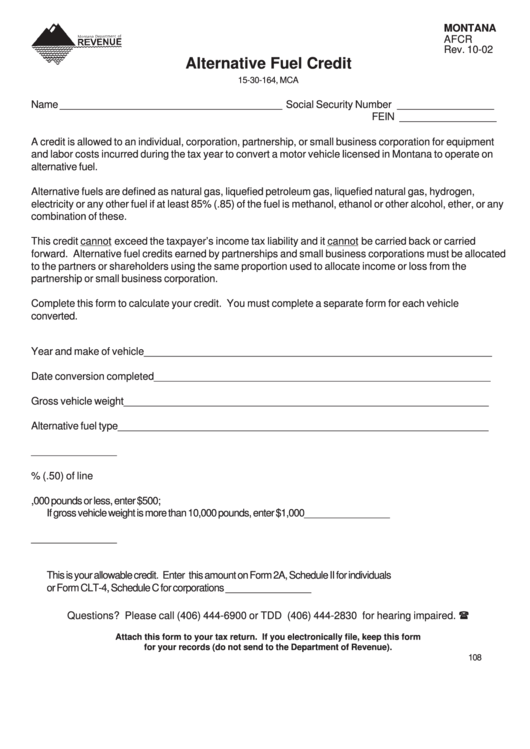

MONTANA

AFCR

Rev. 10-02

Alternative Fuel Credit

15-30-164, MCA

Name _______________________________________ Social Security Number _________________

FEIN _________________

A credit is allowed to an individual, corporation, partnership, or small business corporation for equipment

and labor costs incurred during the tax year to convert a motor vehicle licensed in Montana to operate on

alternative fuel.

Alternative fuels are defined as natural gas, liquefied petroleum gas, liquefied natural gas, hydrogen,

electricity or any other fuel if at least 85% (.85) of the fuel is methanol, ethanol or other alcohol, ether, or any

combination of these.

This credit cannot exceed the taxpayer’s income tax liability and it cannot be carried back or carried

forward. Alternative fuel credits earned by partnerships and small business corporations must be allocated

to the partners or shareholders using the same proportion used to allocate income or loss from the

partnership or small business corporation.

Complete this form to calculate your credit. You must complete a separate form for each vehicle

converted.

Year and make of vehicle _____________________________________________________________

Date conversion completed ___________________________________________________________

Gross vehicle weight ________________________________________________________________

Alternative fuel type _________________________________________________________________

1. Cost of conversion .......................................................................................... 1. _______________

2. Enter 50% (.50) of line 1 ................................................................................. 2. _______________

3. If gross vehicle weight is 10,000 pounds or less, enter $500;

If gross vehicle weight is more than 10,000 pounds, enter $1,000 ............................. 3. _______________

4. Enter the smaller of line 2 or line 3. This is your allowable credit for this vehicle ............ 4. _______________

5. Add the amounts on line 4 from each AFCR Form.

This is your allowable credit. Enter this amount on Form 2A, Schedule II for individuals

or Form CLT-4, Schedule C for corporations .......................................................... 5. _______________

Questions? Please call (406) 444-6900 or TDD (406) 444-2830 for hearing impaired.

Attach this form to your tax return. If you electronically file, keep this form

for your records (do not send to the Department of Revenue).

108

1

1