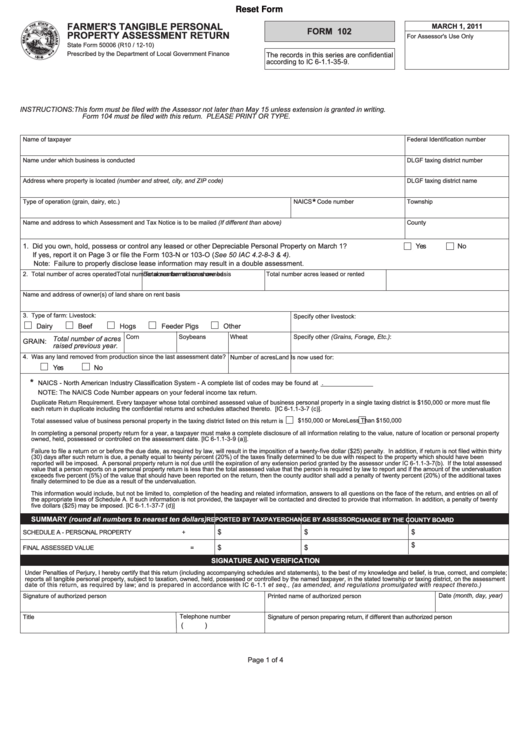

Reset Form

FARMER'S TANGIBLE PERSONAL

MARCH 1, 2011

FORM 102

PROPERTY ASSESSMENT RETURN

For Assessor's Use Only

State Form 50006 (R10 / 12-10)

Prescribed by the Department of Local Government Finance

The records in this series are confidential

according to IC 6-1.1-35-9.

INSTRUCTIONS:

This form must be filed with the Assessor not later than May 15 unless extension is granted in writing.

Form 104 must be filed with this return. PLEASE PRINT OR TYPE.

Name of taxpayer

Federal Identification number

Name under which business is conducted

DLGF taxing district number

Address where property is located (number and street, city, and ZIP code)

DLGF taxing district name

*

Type of operation (grain, dairy, etc.)

NAICS Code number

Township

Name and address to which Assessment and Tax Notice is to be mailed (If different than above)

County

1. Did you own, hold, possess or control any leased or other Depreciable Personal Property on March 1?

Yes

No

If yes, report it on Page 3 or file the Form 103-N or 103-O (See 50 IAC 4.2-8-3 & 4).

Note: Failure to properly disclose lease information may result in a double assessment.

2. Total number of acres operated

Total number of acres owned

Total number acres leased or rented

Total number acres farmed on share basis

Name and address of owner(s) of land share on rent basis

3. Type of farm: Livestock:

Specify other livestock:

Dairy

Beef

Hogs

Feeder Pigs

Other

Corn

Soybeans

Wheat

Specify other (Grains, Forage, Etc.):

GRAIN: Total number of acres

raised previous year.

4. Was any land removed from production since the last assessment date?

Number of acres

Land Is now used for:

Yes

No

*

NAICS - North American Industry Classification System - A complete list of codes may be found at .

NOTE: The NAICS Code Number appears on your federal income tax return.

Duplicate Return Requirement. Every taxpayer whose total combined assessed value of business personal property in a single taxing district is $150,000 or more must file

each return in duplicate including the confidential returns and schedules attached thereto. [IC 6-1.1-3-7 (c)].

$150,000 or More

Less Than $150,000

Total assessed value of business personal property in the taxing district listed on this return is

In completing a personal property return for a year, a taxpayer must make a complete disclosure of all information relating to the value, nature of location or personal property

owned, held, possessed or controlled on the assessment date. [IC 6-1.1-3-9 (a)].

Failure to file a return on or before the due date, as required by law, will result in the imposition of a twenty-five dollar ($25) penalty. In addition, if return is not filed within thirty

(30) days after such return is due, a penalty equal to twenty percent (20%) of the taxes finally determined to be due with respect to the property which should have been

reported will be imposed. A personal property return is not due until the expiration of any extension period granted by the assessor under IC 6-1.1-3-7(b). If the total assessed

value that a person reports on a personal property return is less than the total assessed value that the person is required by law to report and if the amount of the undervaluation

exceeds five percent (5%) of the value that should have been reported on the return, then the county auditor shall add a penalty of twenty percent (20%) of the additional taxes

finally determined to be due as a result of the undervaluation.

This information would include, but not be limited to, completion of the heading and related information, answers to all questions on the face of the return, and entries on all of

the appropriate lines of Schedule A. If such information is not provided, the taxpayer will be contacted and directed to provide that information. In addition, a penalty of twenty

five dollars ($25) may be imposed. [IC 6-1.1-37-7 (d)]

SUMMARY (round all numbers to nearest ten dollars)

REPORTED BY TAXPAYER

CHANGE BY ASSESSOR

CHANGE BY THE COUNTY BOARD

$

$

$

SCHEDULE A - PERSONAL PROPERTY

+

$

$

$

FINAL ASSESSED VALUE

=

SIGNATURE AND VERIFICATION

Under Penalties of Perjury, I hereby certify that this return (including accompanying schedules and statements), to the best of my knowledge and belief, is true, correct, and complete;

reports all tangible personal property, subject to taxation, owned, held, possessed or controlled by the named taxpayer, in the stated township or taxing district, on the assessment

date of this return, as required by law; and is prepared in accordance with IC 6-1.1 et seq., (as amended, and regulations promulgated with respect thereto.)

Date (month, day, year)

Signature of authorized person

Printed name of authorized person

Title

Telephone number

Signature of person preparing return, if different than authorized person

(

)

Page 1 of 4

1

1 2

2 3

3 4

4