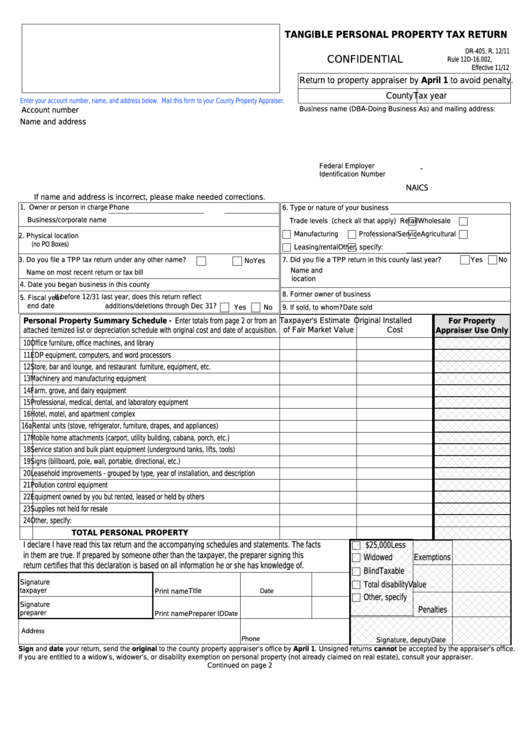

TANGIBLE PERSONAL PROPERTY TAX RETURN

DR-405, R. 12/11

Rule 12D-16.002, F.A.C.

CONFIDENTIAL

Effective 11/12

Return to property appraiser by April 1 to avoid penalty.

County

Tax year

Enter your account number, name, and address below. Mail this form to your County Property Appraiser.

Business name (DBA-Doing Business As) and mailing address:

Account number

Name and address

Federal Employer

-

Identification Number

NAICS

If name and address is incorrect, please make needed corrections.

1. Owner or person in charge

Phone

6. Type or nature of your business

Business/corporate name

Trade levels (check all that apply)

Retail

Wholesale

Manufacturing

Professional

Service

Agricultural

2. Physical location

(no PO Boxes)

Leasing/rental

Other, specify:

3. Do you file a TPP tax return under any other name?

7. Did you file a TPP return in this county last year?

Yes

No

Yes

No

Name and

Name on most recent return or tax bill

location

4. Date you began business in this county

8. Former owner of business

If before 12/31 last year, does this return reflect

5. Fiscal year

end date

additions/deletions through Dec 31?

Yes

No

9. If sold, to whom?

Date sold

Personal Property Summary Schedule - Enter totals from page 2 or from an

Taxpayer's Estimate

Original Installed

For Property

attached itemized list or depreciation schedule with original cost and date of acquisition.

of Fair Market Value

Cost

Appraiser Use Only

10 Office furniture, office machines, and library

11 EDP equipment, computers, and word processors

12 Store, bar and lounge, and restaurant furniture, equipment, etc.

13 Machinery and manufacturing equipment

14 Farm, grove, and dairy equipment

15 Professional, medical, dental, and laboratory equipment

16 Hotel, motel, and apartment complex

16a Rental units (stove, refrigerator, furniture, drapes, and appliances)

17 Mobile home attachments (carport, utility building, cabana, porch, etc.)

18 Service station and bulk plant equipment (underground tanks, lifts, tools)

19 Signs (billboard, pole, wall, portable, directional, etc.)

20 Leasehold improvements - grouped by type, year of installation, and description

21 Pollution control equipment

22 Equipment owned by you but rented, leased or held by others

23 Supplies not held for resale

24 Other, specify:

TOTAL PERSONAL PROPERTY

I declare I have read this tax return and the accompanying schedules and statements. The facts

$25,000

Less

in them are true. If prepared by someone other than the taxpayer, the preparer signing this

Widowed

Exemptions

return certifies that this declaration is based on all information he or she has knowledge of.

Blind

Taxable

Total disability

Value

Signature

Date

taxpayer

Title

Print name

Other, specify

Signature

Penalties

Date

preparer

Print name

Preparer ID

Address

Phone

Signature, deputy

Date

Sign and date your return, send the original to the county property appraiser’s office by April 1. Unsigned returns cannot be accepted by the appraiser’s office.

If you are entitled to a widow’s, widower’s, or disability exemption on personal property (not already claimed on real estate), consult your appraiser.

Continued on page 2

1

1 2

2 3

3 4

4