Form 62a384-G - Natural Gas Property Tax Return - 2011

ADVERTISEMENT

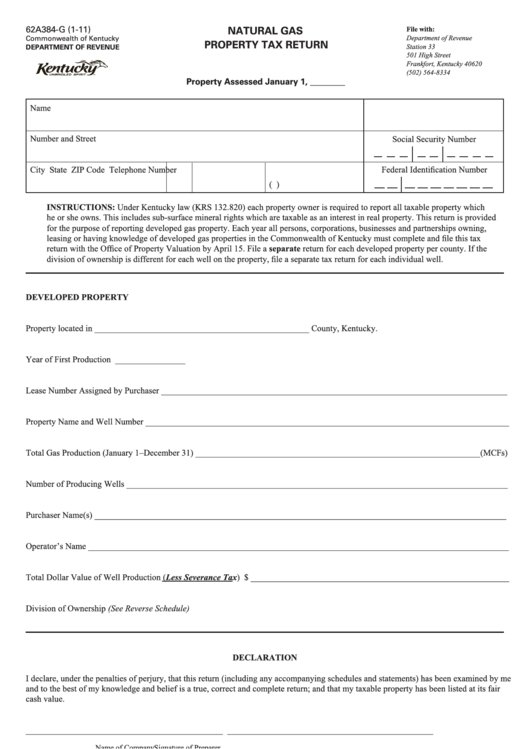

62A384-G (1-11)

File with:

NATURAL GAS

Department of Revenue

Commonwealth of Kentucky

PROPERTY TAX RETURN

Station 33

DEPARTMENT OF REVENUE

501 High Street

Frankfort, Kentucky 40620

(502) 564-8334

Property Assessed January 1, ________

Name

Number and Street

Social Security Number

City

State ZIP Code

Telephone Number

Federal Identification Number

(

)

INSTRUCTIONS: Under Kentucky law (KRS 132.820) each property owner is required to report all taxable property which

he or she owns. This includes sub-surface mineral rights which are taxable as an interest in real property. This return is provided

for the purpose of reporting developed gas property. Each year all persons, corporations, businesses and partnerships owning,

leasing or having knowledge of developed gas properties in the Commonwealth of Kentucky must complete and file this tax

return with the Office of Property Valuation by April 15. File a separate return for each developed property per county. If the

division of ownership is different for each well on the property, file a separate tax return for each individual well.

DEVELOPED PROPERTY

Property located in _________________________________________________ County, Kentucky.

Year of First Production ________________

Lease Number Assigned by Purchaser _______________________________________________________________________________

Property Name and Well Number ___________________________________________________________________________________

Total Gas Production (January 1–December 31) _________________________________________________________________(MCFs)

Number of Producing Wells _______________________________________________________________________________________

Purchaser Name(s) ______________________________________________________________________________________________

Operator’s Name ________________________________________________________________________________________________

Total Dollar Value of Well Production (Less Severance Tax) $ ___________________________________________________________

Division of Ownership (See Reverse Schedule)

DECLARATION

I declare, under the penalties of perjury, that this return (including any accompanying schedules and statements) has been examined by me

and to the best of my knowledge and belief is a true, correct and complete return; and that my taxable property has been listed at its fair

cash value.

_____________________________________________

_______________________________________________

Name of Company

Signature of Preparer

_____________________________________________

_______________________________________________

Signature of Producer/Operator

Date

Filings received after April 15 will be treated as omitted with applicable penalties applied.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2