Llc Or Trustee Declaration Required Prior To Signing Firpta Certification Of Nonforeign Status Page 2

ADVERTISEMENT

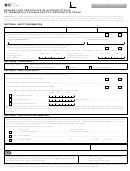

TRUST

The person that should sign the FIRPTA Certification of Nonforeign Status under Code

§1445 depends on whether or not the trust constitutes a “grantor trust” under Code §§671– 679.

If the trust is a “grantor trust”, then the grantor of the trust is deemed the owner of the trust assets

for income tax purposes and that person should sign the FIRPTA Certification. On the other

hand, if the trust is NOT a “grantor trust”, then the Trustee is deemed the owner of the trust

assets for tax purposes and the trustee should sign the FIRPTA Certification. Therefore, in order

for a selling trustee to determine how to sign the FIRPTA Certification of Nonforeign Seller for

Buyer, Seller’s tax advisor must determine whether or not the trust is a “grantor trust” under

Code §§671-679.

3.

Trustee, as the Legal Owner, hereby certifies that Trustee has consulted with its tax advisor

and after such consultation, both the Legal Owner and its tax advisor have determined that

the Legal Owner is:

(check & initial one of two choices.)

____ [ ]

A “grantor trust” under IRC §§671-679 and the owner of the trust assets is

(the “Transferor”).

____ [ ]

NOT a “grantor trust” under IRC §§671-679. Therefore, the Legal Owner is NOT

a disregarded entity and filed a separate federal income tax return Form _______.

* * * * * * * * * * * * * * * * *

Under penalties of perjury, I declare that I have examined this certification; and to the

best of my knowledge and belief, it is true, correct and complete. I further declare that I have

authority to sign this document on behalf of Legal Owner.

Signed:

Print Name:

Title:

Dated:

C:\law-docs\foreign\FIRPTA\Cert\masters\FIRPTA-Declaration.doc

Rev. 03/22/05

- Page 2 of 2 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2