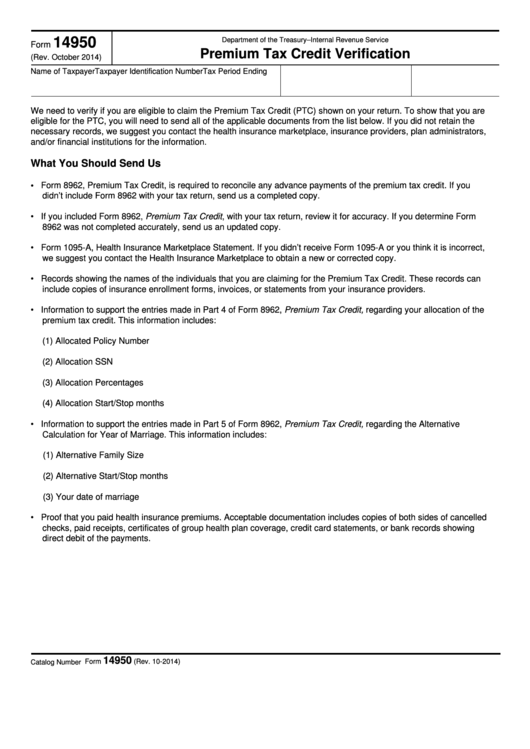

14950

Department of the Treasury–Internal Revenue Service

Form

Premium Tax Credit Verification

(Rev. October 2014)

Name of Taxpayer

Taxpayer Identification Number

Tax Period Ending

We need to verify if you are eligible to claim the Premium Tax Credit (PTC) shown on your return. To show that you are

eligible for the PTC, you will need to send all of the applicable documents from the list below. If you did not retain the

necessary records, we suggest you contact the health insurance marketplace, insurance providers, plan administrators,

and/or financial institutions for the information.

What You Should Send Us

• Form 8962, Premium Tax Credit, is required to reconcile any advance payments of the premium tax credit. If you

didn’t include Form 8962 with your tax return, send us a completed copy.

• If you included Form 8962, Premium Tax Credit, with your tax return, review it for accuracy. If you determine Form

8962 was not completed accurately, send us an updated copy.

• Form 1095-A, Health Insurance Marketplace Statement. If you didn’t receive Form 1095-A or you think it is incorrect,

we suggest you contact the Health Insurance Marketplace to obtain a new or corrected copy.

• Records showing the names of the individuals that you are claiming for the Premium Tax Credit. These records can

include copies of insurance enrollment forms, invoices, or statements from your insurance providers.

• Information to support the entries made in Part 4 of Form 8962, Premium Tax Credit, regarding your allocation of the

premium tax credit. This information includes:

(1) Allocated Policy Number

(2) Allocation SSN

(3) Allocation Percentages

(4) Allocation Start/Stop months

• Information to support the entries made in Part 5 of Form 8962, Premium Tax Credit, regarding the Alternative

Calculation for Year of Marriage. This information includes:

(1) Alternative Family Size

(2) Alternative Start/Stop months

(3) Your date of marriage

• Proof that you paid health insurance premiums. Acceptable documentation includes copies of both sides of cancelled

checks, paid receipts, certificates of group health plan coverage, credit card statements, or bank records showing

direct debit of the payments.

14950

Form

(Rev. 10-2014)

Catalog Number 65540P

1

1