Business Tax Receipt Application

Download a blank fillable Business Tax Receipt Application in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Business Tax Receipt Application with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

The City of Weston

17200 Royal Palm Boulevard

Weston, Florida 33326

954-385-2000

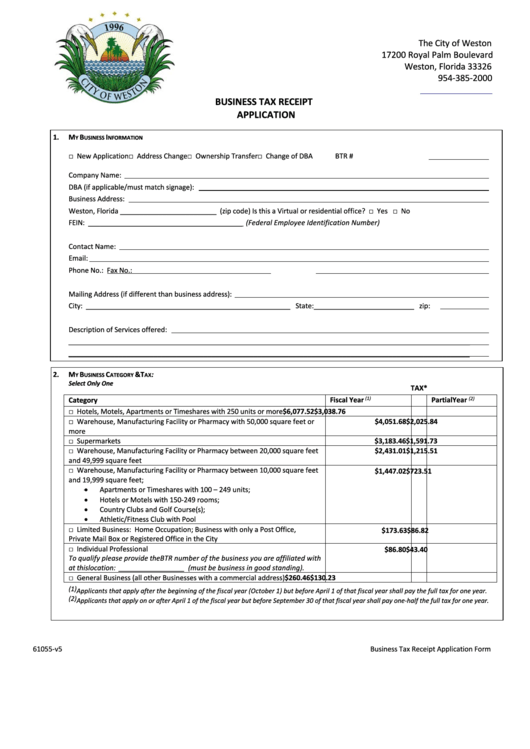

BUSINESS TAX RECEIPT

APPLICATION

1.

M

B

I

Y

USINESS

NFORMATION

□ New Application

□ Address Change

□ Ownership Transfer

□ Change of DBA

BTR #

Company Name:

DBA (if applicable/must match signage):

Business Address:

Weston, Florida _________________________ (zip code)

Is this a Virtual or residential office? □ Yes □ No

FEIN: ________________________________________ (Federal Employee Identification Number)

Contact Name:

Email:

Phone No.:

Fax No.:

Mailing Address (if different than business address):

City: _____________________________________________________ State: __________________________ zip:

Description of Services offered:

________________________________________________________________________________________________________

________________________________________________________________________________________________________

2.

M

B

C

& T

:

Y

USINESS

ATEGORY

AX

Select Only One

TAX*

Category

Fiscal Year

(1)

Partial Year

(2)

□ Hotels, Motels, Apartments or Timeshares with 250 units or more

$6,077.52

$3,038.76

$4,051.68

$2,025.84

□ Warehouse, Manufacturing Facility or Pharmacy with 50,000 square feet or

more

□ Supermarkets

$3,183.46

$1,591.73

□ Warehouse, Manufacturing Facility or Pharmacy between 20,000 square feet

$2,431.01

$1,215.51

and 49,999 square feet

□ Warehouse, Manufacturing Facility or Pharmacy between 10,000 square feet

$1,447.02

$723.51

and 19,999 square feet;

•

Apartments or Timeshares with 100 – 249 units;

•

Hotels or Motels with 150-249 rooms;

•

Country Clubs and Golf Course(s);

•

Athletic/Fitness Club with Pool

□ Limited Business: Home Occupation; Business with only a Post Office,

$173.63

$86.82

Private Mail Box or Registered Office in the City

□ Individual Professional

$86.80

$43.40

To qualify please provide the BTR number of the business you are affiliated with

at this location: _________________ (must be business in good standing).

□ General Business (all other Businesses with a commercial address)

$260.46

$130.23

(1) Applicants that apply after the beginning of the fiscal year (October 1) but before April 1 of that fiscal year shall pay the full tax for one year.

(2) Applicants that apply on or after April 1 of the fiscal year but before September 30 of that fiscal year shall pay one-half the full tax for one year.

61055-v5

Business Tax Receipt Application Form

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2