PRINT FORM

CLEAR FORM

12-302

(Rev.4-14/18)

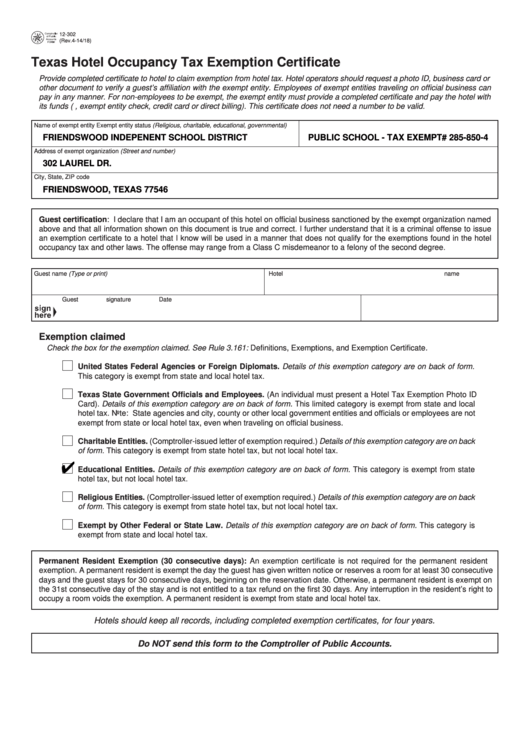

Texas Hotel Occupancy Tax Exemption Certificate

Provide completed certificate to hotel to claim exemption from hotel tax. Hotel operators should request a photo ID, business card or

other document to verify a guest’s affiliation with the exempt entity. Employees of exempt entities traveling on official business can

pay in any manner. For non-employees to be exempt, the exempt entity must provide a completed certificate and pay the hotel with

its funds (e.g., exempt entity check, credit card or direct billing). This certificate does not need a number to be valid.

Name of exempt entity

Exempt entity status (Religious, charitable, educational, governmental)

FRIENDSWOOD INDEPENENT SCHOOL DISTRICT

PUBLIC SCHOOL - TAX EXEMPT# 285-850-4

Address of exempt organization (Street and number)

302 LAUREL DR.

City, State, ZIP code

FRIENDSWOOD, TEXAS 77546

Guest certification: I declare that I am an occupant of this hotel on official business sanctioned by the exempt organization named

above and that all information shown on this document is true and correct. I further understand that it is a criminal offense to issue

an exemption certificate to a hotel that I know will be used in a manner that does not qualify for the exemptions found in the hotel

occupancy tax and other laws. The offense may range from a Class C misdemeanor to a felony of the second degree.

Guest name (Type or print)

Hotel name

Guest signature

Date

Exemption claimed

Check the box for the exemption claimed. See Rule 3.161: Definitions, Exemptions, and Exemption Certificate.

United States Federal Agencies or Foreign Diplomats. Details of this exemption category are on back of form.

This category is exempt from state and local hotel tax.

Texas State Government Officials and Employees. (An individual must present a Hotel Tax Exemption Photo ID

Card). Details of this exemption category are on back of form. This limited category is exempt from state and local

hotel tax. Note: State agencies and city, county or other local government entities and officials or employees are not

exempt from state or local hotel tax, even when traveling on official business.

Charitable Entities. (Comptroller-issued letter of exemption required.) Details of this exemption category are on back

of form. This category is exempt from state hotel tax, but not local hotel tax.

Educational Entities. Details of this exemption category are on back of form. This category is exempt from state

hotel tax, but not local hotel tax.

Religious Entities. (Comptroller-issued letter of exemption required.) Details of this exemption category are on back

of form. This category is exempt from state hotel tax, but not local hotel tax.

Exempt by Other Federal or State Law. Details of this exemption category are on back of form. This category is

exempt from state and local hotel tax.

Permanent Resident Exemption (30 consecutive days): An exemption certificate is not required for the permanent resident

exemption. A permanent resident is exempt the day the guest has given written notice or reserves a room for at least 30 consecutive

days and the guest stays for 30 consecutive days, beginning on the reservation date. Otherwise, a permanent resident is exempt on

the 31st consecutive day of the stay and is not entitled to a tax refund on the first 30 days. Any interruption in the resident’s right to

occupy a room voids the exemption. A permanent resident is exempt from state and local hotel tax.

Hotels should keep all records, including completed exemption certificates, for four years.

Do NOT send this form to the Comptroller of Public Accounts.

1

1 2

2