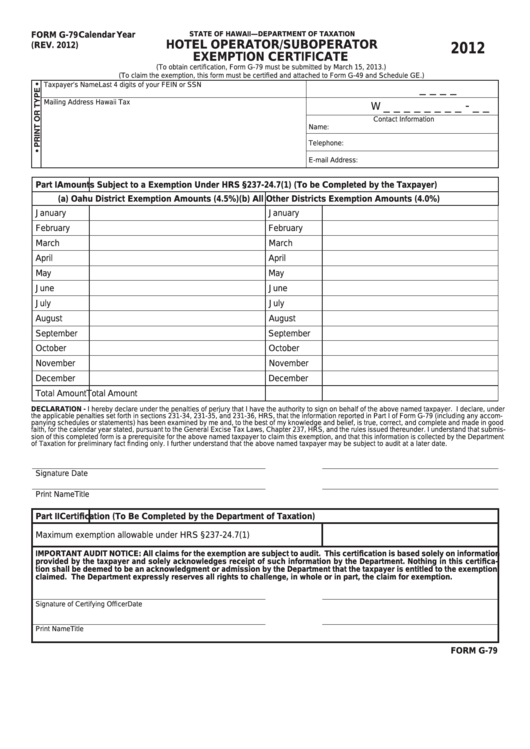

FORM G-79

Calendar Year

STATE OF HAWAII—DEPARTMENT OF TAXATION

HOTEL OPERATOR/SUBOPERATOR

2012

(REV. 2012)

EXEMPTION CERTIFICATE

(To obtain certification, Form G-79 must be submitted by March 15, 2013.)

(To claim the exemption, this form must be certified and attached to Form G-49 and Schedule GE.)

Taxpayer’s Name

Last 4 digits of your FEIN or SSN

_ _ _ _

Mailing Address

Hawaii Tax I.D. No.

_ _ _ _ _ _ _ _ - _ _

W

Contact Information

Name:

Telephone:

E-mail Address:

Part I

Amounts Subject to a Exemption Under HRS §237-24.7(1) (To be Completed by the Taxpayer)

(a) Oahu District Exemption Amounts (4.5%)

(b) All Other Districts Exemption Amounts (4.0%)

January

January

February

February

March

March

April

April

May

May

June

June

July

July

August

August

September

September

October

October

November

November

December

December

Total Amount

Total Amount

DECLARATION - I hereby declare under the penalties of perjury that I have the authority to sign on behalf of the above named taxpayer. I declare, under

the applicable penalties set forth in sections 231-34, 231-35, and 231-36, HRS, that the information reported in Part I of Form G-79 (including any accom-

panying schedules or statements) has been examined by me and, to the best of my knowledge and belief, is true, correct, and complete and made in good

faith, for the calendar year stated, pursuant to the General Excise Tax Laws, Chapter 237, HRS, and the rules issued thereunder. I understand that submis-

sion of this completed form is a prerequisite for the above named taxpayer to claim this exemption, and that this information is collected by the Department

of Taxation for preliminary fact finding only. I further understand that the above named taxpayer may be subject to audit at a later date.

Signature

Date

Print Name

Title

Part II

Certification (To Be Completed by the Department of Taxation)

Maximum exemption allowable under HRS §237-24.7(1)

IMPORTANT AUDIT NOTICE: All claims for the exemption are subject to audit. This certification is based solely on information

provided by the taxpayer and solely acknowledges receipt of such information by the Department. Nothing in this certifica-

tion shall be deemed to be an acknowledgment or admission by the Department that the taxpayer is entitled to the exemption

claimed. The Department expressly reserves all rights to challenge, in whole or in part, the claim for exemption.

Signature of Certifying Officer

Date

Print Name

Title

FORM G-79

1

1 2

2