Form Rl-26-L - Schedule L Instructions

ADVERTISEMENT

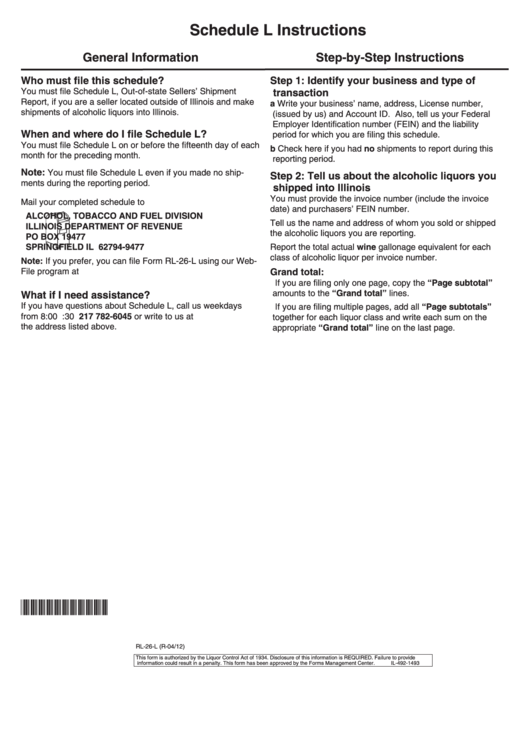

Schedule L Instructions

General Information

Step-by-Step Instructions

Who must file this schedule?

Step 1: Identify your business and type of

You must file Schedule L, Out-of-state Sellers’ Shipment

transaction

Report, if you are a seller located outside of Illinois and make

a Write your business’ name, address, License number,

shipments of alcoholic liquors into Illinois.

(issued by us) and Account ID. Also, tell us your Federal

Employer Identification number (FEIN) and the liability

When and where do I file Schedule L?

period for which you are filing this schedule.

You must file Schedule L on or before the fifteenth day of each

b Check here if you had no shipments to report during this

month for the preceding month.

reporting period.

Note:

You must file Schedule L even if you made no ship-

Step 2: Tell us about the alcoholic liquors you

ments during the reporting period.

shipped into Illinois

You must provide the invoice number (include the invoice

Mail your completed schedule to

date) and purchasers’ FEIN number.

ALCOHOL, TOBACCO AND FUEL DIVISION

Tell us the name and address of whom you sold or shipped

ILLINOIS DEPARTMENT OF REVENUE

the alcoholic liquors you are reporting.

PO BOX 19477

SPRINGFIELD IL 62794-9477

Report the total actual wine gallonage equivalent for each

class of alcoholic liquor per invoice number.

Note: If you prefer, you can file Form RL-26-L using our Web-

File program at tax.illinois.gov.

Grand total:

If you are filing only one page, copy the “Page subtotal”

amounts to the “Grand total” lines.

What if I need assistance?

If you have questions about Schedule L, call us weekdays

If you are filing multiple pages, add all “Page subtotals”

from 8:00 a.m. to 4:30 p.m. at 217 782-6045 or write to us at

together for each liquor class and write each sum on the

the address listed above.

appropriate “Grand total” line on the last page.

*ZZZZZZZZZ*

RL-26-L (R-04/12)

This form is authorized by the Liquor Control Act of 1934. Disclosure of this information is REQUIRED. Failure to provide

information could result in a penalty. This form has been approved by the Forms Management Center.

IL-492-1493

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1