Asi Flexible Spending Account Enrollment Form

ADVERTISEMENT

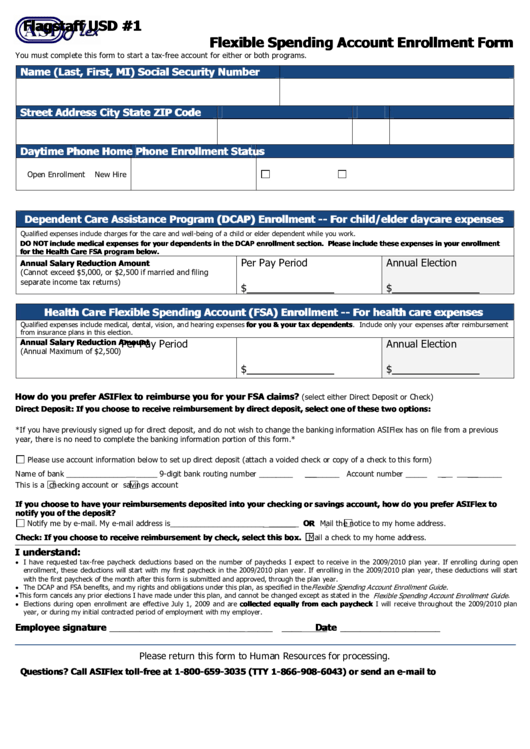

Flagstaff USD #1

Flexible Spending Account Enrollment Form

You must complete this form to start a tax-free account for either or both programs.

Name (Last, First, MI)

Social Security Number

Street Address

City

State ZIP Code

Daytime Phone

Home Phone

Enrollment Status

Open Enrollment

New Hire

Dependent Care Assistance Program (DCAP) Enrollment -- For child/elder daycare expenses

Qualified expenses include charges for the care and well-being of a child or elder dependent while you work.

DO NOT include medical expenses for your dependents in the DCAP enrollment section. Please include these expenses in your enrollment

for the Health Care FSA program below.

Per Pay Period

Annual Election

Annual Salary Reduction Amount

(Cannot exceed $5,000, or $2,500 if married and filing

separate income tax returns)

$

$

Health Care Flexible Spending Account (FSA) Enrollment -- For health care expenses

Qualified expenses include medical, dental, vision, and hearing expenses for you & your tax dependents. Include only your expenses after reimbursement

from insurance plans in this election.

Annual Salary Reduction Amount

Per Pay Period

Annual Election

(Annual Maximum of $2,500)

$

$

How do you prefer ASIFlex to reimburse you for your FSA claims?

(select either Direct Deposit or Check)

Direct Deposit: If you choose to receive reimbursement by direct deposit, select one of these two options:

*If you have previously signed up for direct deposit, and do not wish to change the banking information ASIFlex has on file from a previous

year, there is no need to complete the banking information portion of this form.*

Please use account information below to set up direct deposit (attach a voided check or copy of a check to this form)

Name of bank ______________

_____

9-digit bank routing number ________

________ Account number _____

_

________

This is a

checking account or

savings account

If you choose to have your reimbursements deposited into your checking or savings account, how do you prefer ASIFlex to

notify you of the deposit?

Notify me by e-mail. My e-mail address is______________________

_______ OR

Mail the notice to my home address.

Check: If you choose to receive reimbursement by check, select this box.

Mail a check to my home address.

I understand:

• I have requested tax-free paycheck deductions based on the number of paychecks I expect to receive in the 2009/2010 plan year. If enrolling during open

enrollment, these deductions will start with my first paycheck in the 2009/2010 plan year. If enrolling in the 2009/2010 plan year, these deductions will start

with the first paycheck of the month after this form is submitted and approved, through the plan year.

• The DCAP and FSA benefits, and my rights and obligations under this plan, as specified in the

Flexible Spending Account Enrollment Guide

.

Flexible Spending Account Enrollment Guide

• This form cancels any prior elections I have made under this plan, and cannot be changed except as stated in the

.

• Elections during open enrollment are effective July 1, 2009 and are collected equally from each paycheck I will receive throughout the 2009/2010 plan

year, or during my initial contracted period of employment with my employer.

Employee signature ___________________________

_____

____

Date ____________________

Please return this form to Human Resources for processing.

Questions? Call ASIFlex toll-free at 1-800-659-3035 (TTY 1-866-908-6043) or send an e-mail to

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1