Annual Tax Free Flexible Spending Account Enrollment Form

ADVERTISEMENT

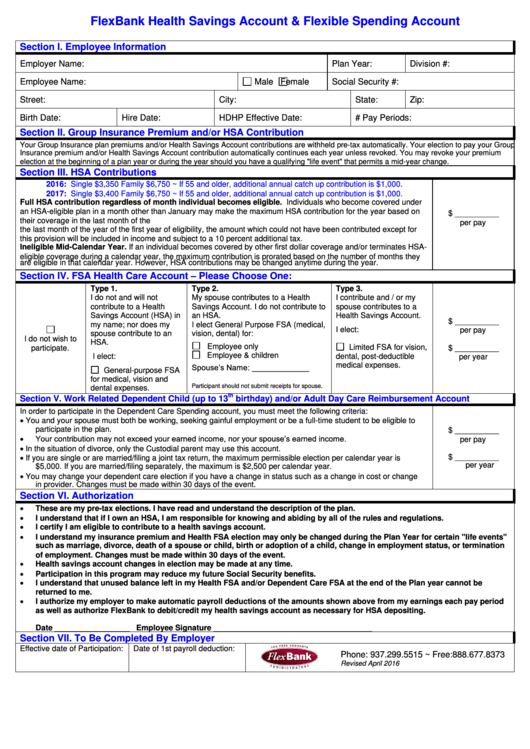

FlexBank Health Savings Account & Flexible Spending Account

Section I. Employee Information

Employer Name:

Plan Year:

Division #:

Employee Name:

Male

Female

Social Security #:

Street:

City:

State:

Zip:

Birth Date:

Hire Date:

HDHP Effective Date:

# Pay Periods:

Section II. Group Insurance Premium and/or HSA Contribution

Your Group Insurance plan premiums and/or Health Savings Account contributions are withheld pre-tax automatically. Your election to pay your Group

Insurance premium and/or Health Savings Account contribution automatically continues each year unless revoked. You may revoke your premium

election at the beginning of a plan year or during the year should you have a qualifying "life event" that permits a mid-year change.

Section III. HSA Contributions

2016: Single $3,350 Family $6,750 ~ If 55 and older, additional annual catch up contribution is $1,000.

2017: Single $3,400 Family $6,750 ~ If 55 and older, additional annual catch up contribution is $1,000.

Full HSA contribution regardless of month individual becomes eligible. Individuals who become covered under

an HSA-eligible plan in a month other than January may make the maximum HSA contribution for the year based on

$ __________

their coverage in the last month of the year. If an individual does not stay in the HSA-eligible plan 12 months following

per pay

the last month of the year of the first year of eligibility, the amount which could not have been contributed except for

this provision will be included in income and subject to a 10 percent additional tax.

Ineligible Mid-Calendar Year. If an individual becomes covered by other first dollar coverage and/or terminates HSA-

eligible coverage during a calendar year, the maximum contribution is prorated based on the number of months they

are eligible in that calendar year. However, HSA contributions may be changed anytime during the year.

Section IV. FSA Health Care Account – Please Choose One:

Type 1.

Type 2.

Type 3.

I do not and will not

My spouse contributes to a Health

I contribute and / or my

contribute to a Health

Savings Account. I do not contribute to

spouse contributes to a

Savings Account (HSA) in

an HSA.

Health Savings Account.

$ __________

my name; nor does my

I elect General Purpose FSA (medical,

I elect:

per pay

spouse contribute to an

vision, dental) for:

I do not wish to

HSA.

Employee only

Limited FSA for vision,

participate.

$ __________

Employee & children

I elect:

dental, post-deductible

per year

medical expenses.

Spouse’s Name: _____________

General-purpose FSA

for medical, vision and

Participant should not submit receipts for spouse.

dental expenses.

th

Section V. Work Related Dependent Child (up to 13

birthday) and/or Adult Day Care Reimbursement Account

In order to participate in the Dependent Care Spending account, you must meet the following criteria:

You and your spouse must both be working, seeking gainful employment or be a full-time student to be eligible to

participate in the plan.

$ __________

Your contribution may not exceed your earned income, nor your spouse’s earned income.

per pay

In the situation of divorce, only the Custodial parent may use this account.

$ __________

If you are single or are married/filing a joint tax return, the maximum permissible election per calendar year is

per year

$5,000. If you are married/filing separately, the maximum is $2,500 per calendar year.

You may change your dependent care election if you have a change in status such as a change in cost or change

in provider. Changes must be made within 30 days of the event.

Section VI. Authorization

These are my pre-tax elections. I have read and understand the description of the plan.

I understand that if I own an HSA, I am responsible for knowing and abiding by all of the rules and regulations.

I certify I am eligible to contribute to a health savings account.

I understand my insurance premium and Health FSA election may only be changed during the Plan Year for certain "life events"

such as marriage, divorce, death of a spouse or child, birth or adoption of a child, change in employment status, or termination

of employment. Changes must be made within 30 days of the event.

Health savings account changes in election may be made at any time.

Participation in this program may reduce my future Social Security benefits.

I understand that unused balance left in my Health FSA and/or Dependent Care FSA at the end of the Plan year cannot be

returned to me.

I authorize my employer to make automatic payroll deductions of the amounts shown above from my earnings each pay period

as well as authorize FlexBank to debit/credit my health savings account as necessary for HSA depositing.

Date _________________

Employee Signature ____________________________________

Section VII. To Be Completed By Employer

Effective date of Participation:

Date of 1st payroll deduction:

Phone: 937.299.5515 ~ Free:888.677.8373

Revised April 2016

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1