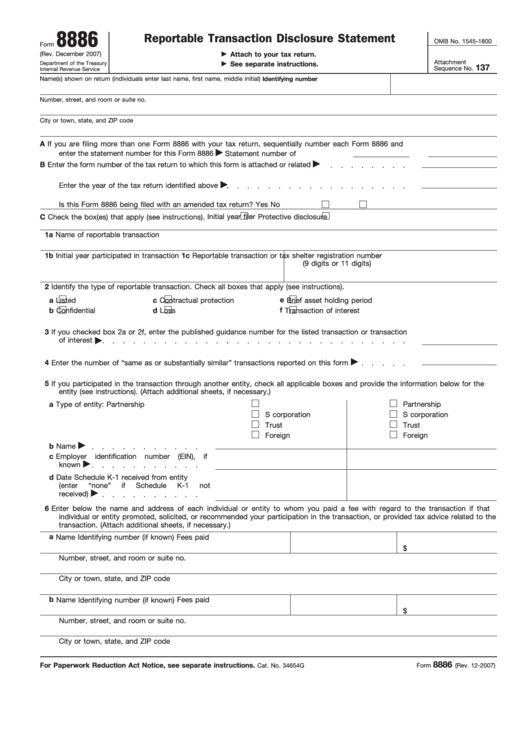

8886

Reportable Transaction Disclosure Statement

OMB No. 1545-1800

Form

(Rev. December 2007)

Attach to your tax return.

Attachment

Department of the Treasury

See separate instructions.

137

Sequence No.

Internal Revenue Service

Name(s) shown on return (individuals enter last name, first name, middle initial)

Identifying number

Number, street, and room or suite no.

City or town, state, and ZIP code

A

If you are filing more than one Form 8886 with your tax return, sequentially number each Form 8886 and

enter the statement number for this Form 8886

Statement number

of

B

Enter the form number of the tax return to which this form is attached or related

Enter the year of the tax return identified above

Is this Form 8886 being filed with an amended tax return?

Yes

No

Initial year filer

Protective disclosure

C

Check the box(es) that apply (see instructions).

1a Name of reportable transaction

1b Initial year participated in transaction

1c Reportable transaction or tax shelter registration number

(9 digits or 11 digits)

2

Identify the type of reportable transaction. Check all boxes that apply (see instructions).

e

a

Listed

c

Contractual protection

Brief asset holding period

Confidential

d

Loss

f

Transaction of interest

b

3

If you checked box 2a or 2f, enter the published guidance number for the listed transaction or transaction

of interest

4

Enter the number of “same as or substantially similar” transactions reported on this form

5

If you participated in the transaction through another entity, check all applicable boxes and provide the information below for the

entity (see instructions). (Attach additional sheets, if necessary.)

a Type of entity:

Partnership

Partnership

S corporation

S corporation

Trust

Trust

Foreign

Foreign

b Name

c Employer

identification

number

(EIN),

if

known

d Date Schedule K-1 received from entity

(enter

“none”

if

Schedule

K-1

not

received)

6

Enter below the name and address of each individual or entity to whom you paid a fee with regard to the transaction if that

individual or entity promoted, solicited, or recommended your participation in the transaction, or provided tax advice related to the

transaction. (Attach additional sheets, if necessary.)

a Name

Identifying number (if known)

Fees paid

$

Number, street, and room or suite no.

City or town, state, and ZIP code

b Name

Fees paid

Identifying number (if known)

$

Number, street, and room or suite no.

City or town, state, and ZIP code

8886

For Paperwork Reduction Act Notice, see separate instructions.

Cat. No. 34654G

Form

(Rev. 12-2007)

1

1 2

2