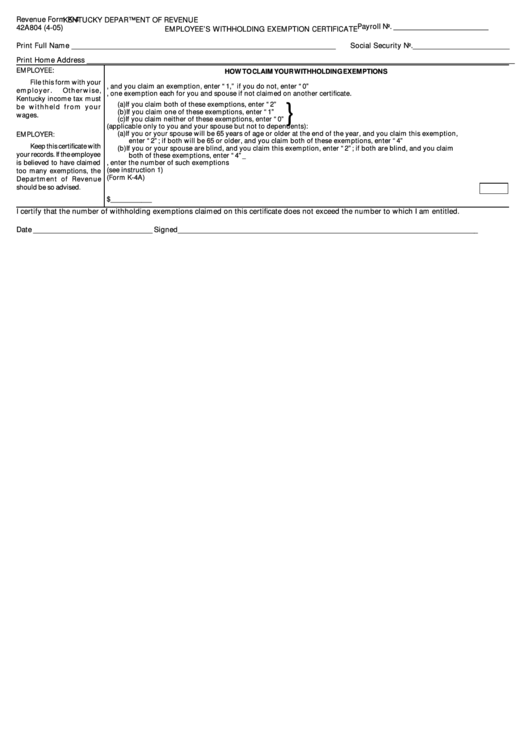

Revenue Form K-4 - Employee'S Withholding Exemption Certificate - 2005

ADVERTISEMENT

Revenue Form K-4

KENTUCKY DEPARTMENT OF REVENUE

Payroll No. __________________________

42A804 (4-05)

EMPLOYEE’S WITHHOLDING EXEMPTION CERTIFICATE

Print Full Name _______________________________________________________________________

Social Security No. __________________________

Print Home Address ___________________________________________________________________________________________________________________

EMPLOYEE:

HOW TO CLAIM YOUR WITHHOLDING EXEMPTIONS

File this form with your

1. If SINGLE, and you claim an exemption, enter “1, ” if you do not, enter “0” ................................................................ ________

employer.

Otherwise,

2. If MARRIED, one exemption each for you and spouse if not claimed on another certificate.

Kentucky income tax must

(a) If you claim both of these exemptions, enter “2”

}

be withheld from your

(b) If you claim one of these exemptions, enter “1”

.............................................................................................. ________

wages.

(c) If you claim neither of these exemptions, enter “0”

3. Exemptions for age and blindness (applicable only to you and your spouse but not to dependents):

(a) If you or your spouse will be 65 years of age or older at the end of the year, and you claim this exemption,

EMPLOYER:

enter “2”; if both will be 65 or older, and you claim both of these exemptions, enter “4” .................................... ________

Keep this certificate with

(b) If you or your spouse are blind, and you claim this exemption, enter “2”; if both are blind, and you claim

your records. If the employee

both of these exemptions, enter “4” ........................................................................................................................ ________

is believed to have claimed

4. If you claim exemptions for one or more dependents, enter the number of such exemptions .................................. ________

5. National Guard exemption (see instruction 1) ............................................................................................................... ________

too many exemptions, the

6. Exemptions for Excess Itemized Deductions (Form K-4A) ............................................................................................ ________

Department of Revenue

should be so advised.

7 . Add the number of exemptions which you have claimed above and enter the total ...................................................

8. Additional withholding per pay period under agreement with employer. See instruction 1 ............................. $ ____________

I certify that the number of withholding exemptions claimed on this certificate does not exceed the number to which I am entitled.

Date _________________________________

Signed___________________________________________________________________________________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2