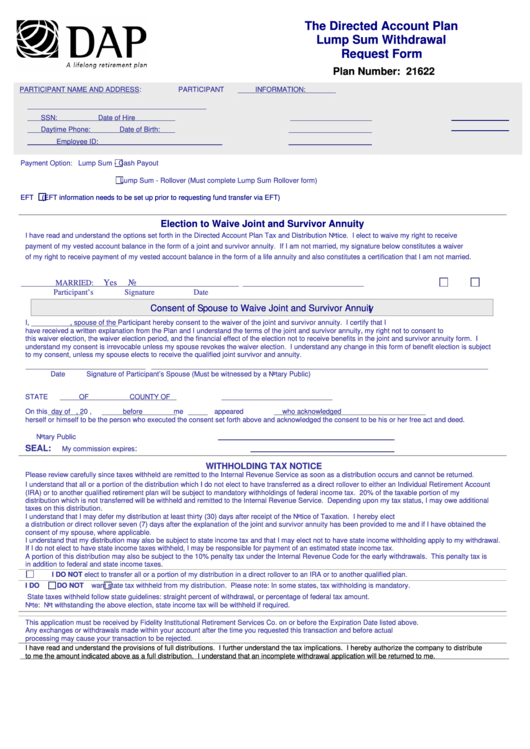

The Directed Account Plan Lump Sum Withdrawal Request Form

ADVERTISEMENT

The Directed Account Plan

Lump Sum Withdrawal

Request Form

Plan Number: 21622

PARTICIPANT NAME AND ADDRESS:

PARTICIPANT INFORMATION:

SSN:

Date of Hire

Daytime Phone:

Date of Birth:

Employee ID:

Payment Option:

Lump Sum - Cash Payout

Lump Sum - Rollover (Must complete Lump Sum Rollover form)

EFT

(EFT information needs to be set up prior to requesting fund transfer via EFT)

Election to Waive Joint and Survivor Annuity

I have read and understand the options set forth in the Directed Account Plan Tax and Distribution Notice. I elect to waive my right to receive

payment of my vested account balance in the form of a joint and survivor annuity. If I am not married, my signature below constitutes a waiver

of my right to receive payment of my vested account balance in the form of a life annuity and also constitutes a certification that I am not married.

Yes

No

MARRIED:

Participant’s Signature

Date

Consent of Spouse to Waive Joint and Survivor Annuity

I,

, spouse of the Participant hereby consent to the waiver of the joint and survivor annuity. I certify that I

have received a written explanation from the Plan and I understand the terms of the joint and survivor annuity, my right not to consent to

this waiver election, the waiver election period, and the financial effect of the election not to receive benefits in the joint and survivor annuity form. I

understand my consent is irrevocable unless my spouse revokes the waiver election. I understand any change in this form of benefit election is subject

to my consent, unless my spouse elects to receive the qualified joint survivor and annuity.

Date

Signature of Participant’s Spouse (Must be witnessed by a Notary Public)

STATE OF

COUNTY OF

On this

day of

, 20

, before me appeared

who acknowledged

herself or himself to be the person who executed the consent set forth above and acknowledged the consent to be his or her free act and deed.

Notary Public

SEAL:

:

My commission expires

WITHHOLDING TAX NOTICE

Please review carefully since taxes withheld are remitted to the Internal Revenue Service as soon as a distribution occurs and cannot be returned.

I understand that all or a portion of the distribution which I do not elect to have transferred as a direct rollover to either an Individual Retirement Account

(IRA) or to another qualified retirement plan will be subject to mandatory withholdings of federal income tax. 20% of the taxable portion of my

distribution which is not transferred will be withheld and remitted to the Internal Revenue Service. Depending upon my tax status, I may owe additional

taxes on this distribution.

I understand that I may defer my distribution at least thirty (30) days after receipt of the Notice of Taxation. I hereby elect

a distribution or direct rollover seven (7) days after the explanation of the joint and survivor annuity has been provided to me and if I have obtained the

consent of my spouse, where applicable.

I understand that my distribution may also be subject to state income tax and that I may elect not to have state income withholding apply to my withdrawal.

If I do not elect to have state income taxes withheld, I may be responsible for payment of an estimated state income tax.

A portion of this distribution may also be subject to the 10% penalty tax under the Internal Revenue Code for the early withdrawals. This penalty tax is

in addition to federal and state income taxes.

I DO NOT elect to transfer all or a portion of my distribution in a direct rollover to an IRA or to another qualified plan.

I DO

DO NOT

want state tax withheld from my distribution. Please note: In some states, tax withholding is mandatory.

State taxes withheld follow state guidelines: straight percent of withdrawal, or percentage of federal tax amount.

Note: Not withstanding the above election, state income tax will be withheld if required.

This application must be received by Fidelity Institutional Retirement Services Co. on or before the Expiration Date listed above.

Any exchanges or withdrawals made within your account after the time you requested this transaction and before actual

processing may cause your transaction to be rejected.

I have read and understand the provisions of full distributions. I further understand the tax implications. I hereby authorize the company to distribute

to me the amount indicated above as a full distribution. I understand that an incomplete withdrawal application will be returned to me.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2