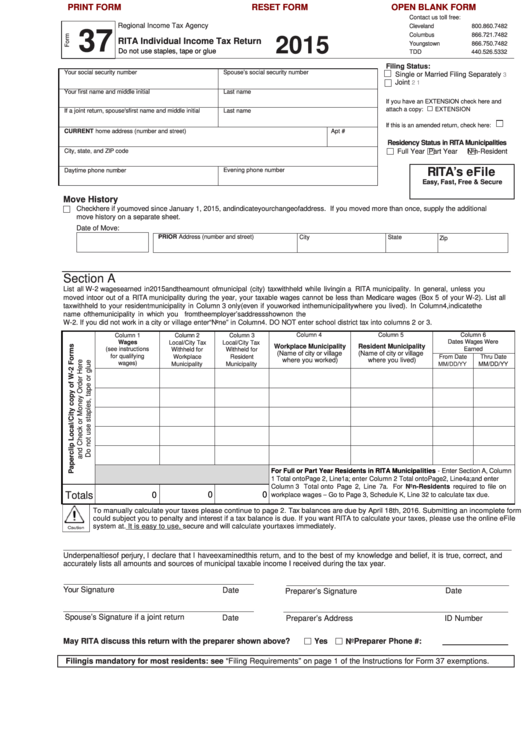

PRINT FORM

RESET FORM

OPEN BLANK FORM

Contact us toll free:

Regional Income Tax Agency

Cleveland

800.860.7482

37

Columbus

866.721.7482

2015

RITA Individual Income Tax Return

Youngstown

866.750.7482

Do not use staples, tape or glue

TDD

440.526.5332

Filing Status:

Your social security number

Spouse’s social security number

Single or Married Filing Separately

3

Joint

2

1

Your first name and middle initial

Last name

If you have an EXTENSION check here and

attach a copy:

EXTENSION

If a joint return, spouse's first name and middle initial

Last name

If this is an amended return, check here:

CURRENT home address (number and street)

Apt #

Residency Status in RITA Municipalities

City, state, and ZIP code

Full Year

Part Year

Non-Resident

RITA’s eFile

Daytime phone number

Evening phone number

Easy, Fast, Free & Secure

Move History

Check here if you moved since January 1, 2015, and indicate your change of address. If you moved more than once, supply the additional

move history on a separate sheet.

Date of Move:

PRIOR Address (number and street)

City

State

Zip

Section A

List all W-2 wages earned in 2015 and the amount of municipal (city) tax withheld while living in a RITA municipality. In general, unless you

moved into or out of a RITA municipality during the year, your taxable wages cannot be less than Medicare wages (Box 5 of your W-2). List all

tax withheld to your resident municipality in Column 3 only (even if you worked in the municipality where you lived). In Column 4, indicate the

name of the municipality in which you or your spouse physically worked. This may be different from the employer’s address shown on the

W-2. If you did not work in a city or village enter “None” in Column 4. DO NOT enter school district tax into columns 2 or 3.

Column 4

Column 5

Column 6

Column 1

Column 2

Column 3

Dates Wages Were

Wages

Local/City Tax

Local/City Tax

Workplace Municipality

Resident Municipality

(see instructions

Earned

Withheld for

Withheld for

(Name of city or village

(Name of city or village

for qualifying

Workplace

Resident

From Date

Thru Date

where you worked)

where you lived)

wages)

Municipality

Municipality

MM/DD/YY

For Full or Part Year Residents in RITA Municipalities -

Enter Section A, Column

1 Total onto Page 2, Line 1a; enter Column 2 Total onto Page 2, Line 4a; and enter

Column 3 Total onto Page 2, Line 7a. For Non-Residents required to file on

workplace wages – Go to Page 3, Schedule K, Line 32 to calculate tax due.

Totals

0

0

0

To manually calculate your taxes please continue to page 2. Tax balances are due by April 18th, 2016. Submitting an incomplete form

could subject you to penalty and interest if a tax balance is due. If you want RITA to calculate your taxes, please use the online eFile

system at . It is easy to use, secure and will calculate your taxes immediately.

Under penalties of perjury, I declare that I have examined this return, and to the best of my knowledge and belief, it is true, correct, and

accurately lists all amounts and sources of municipal taxable income I received during the tax year.

Your Signature

Date

Date

Preparer’s Signature

Spouse’s Signature if a joint return

Date

Preparer’s Address

ID Number

May RITA discuss this return with the preparer shown above?

Yes

Preparer Phone #:

No

Filing is mandatory for most residents: see “Filing Requirements” on page 1 of the Instructions for Form 37 exemptions.

1

1 2

2 3

3