Instructions For Form 37 - Rita Individual Income Tax Return - State Of Ohio

ADVERTISEMENT

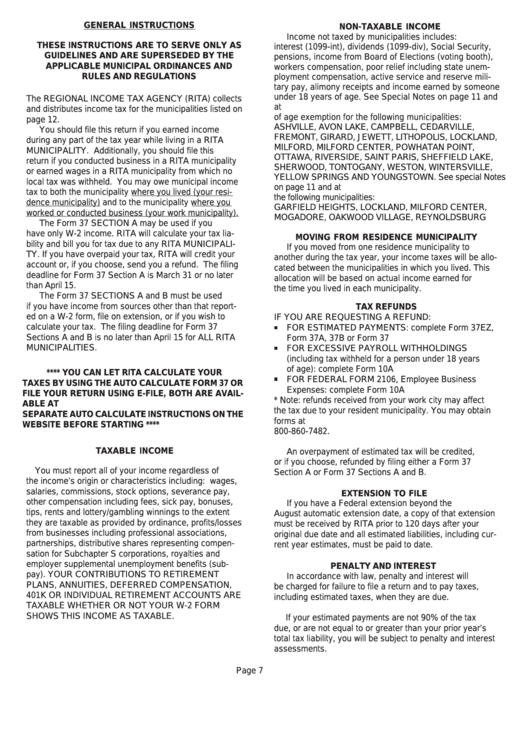

GENERAL INSTRUCTIONS

NON-TAXABLE INCOME

Income not taxed by municipalities includes:

THESE INSTRUCTIONS ARE TO SERVE ONLY AS

interest (1099-int), dividends (1099-div), Social Security,

GUIDELINES AND ARE SUPERSEDED BY THE

pensions, income from Board of Elections (voting booth),

APPLICABLE MUNICIPAL ORDINANCES AND

workers compensation, poor relief including state unem-

RULES AND REGULATIONS

ployment compensation, active service and reserve mili-

tary pay, alimony receipts and income earned by someone

under 18 years of age. See Special Notes on page 11 and

The REGIONAL INCOME TAX AGENCY (RITA) collects

at for exceptions to the under 18 years

and distributes income tax for the municipalities listed on

of age exemption for the following municipalities:

page 12.

ASHVILLE, AVON LAKE, CAMPBELL, CEDARVILLE,

You should file this return if you earned income

FREMONT, GIRARD, JEWETT, LITHOPOLIS, LOCKLAND,

during any part of the tax year while living in a RITA

MILFORD, MILFORD CENTER, POWHATAN POINT,

MUNICIPALITY. Additionally, you should file this

OTTAWA, RIVERSIDE, SAINT PARIS, SHEFFIELD LAKE,

return if you conducted business in a RITA municipality

SHERWOOD, TONTOGANY, WESTON, WINTERSVILLE,

or earned wages in a RITA municipality from which no

YELLOW SPRINGS AND YOUNGSTOWN. See special Notes

local tax was withheld. You may owe municipal income

on page 11 and at for other exemptions for

tax to both the municipality where you lived (your resi-

the following municipalities:

dence municipality) and to the municipality where you

GARFIELD HEIGHTS, LOCKLAND, MILFORD CENTER,

worked or conducted business (your work municipality).

MOGADORE, OAKWOOD VILLAGE, REYNOLDSBURG

The Form 37 SECTION A may be used if you

have only W-2 income. RITA will calculate your tax lia-

MOVING FROM RESIDENCE MUNICIPALITY

bility and bill you for tax due to any RITA MUNICIPALI-

If you moved from one residence municipality to

TY. If you have overpaid your tax, RITA will credit your

another during the tax year, your income taxes will be allo-

account or, if you choose, send you a refund. The filing

cated between the municipalities in which you lived. This

deadline for Form 37 Section A is March 31 or no later

allocation will be based on actual income earned for

than April 15.

the time you lived in each municipality.

The Form 37 SECTIONS A and B must be used

if you have income from sources other than that report-

TAX REFUNDS

ed on a W-2 form, file on extension, or if you wish to

IF YOU ARE REQUESTING A REFUND:

calculate your tax. The filing deadline for Form 37

FOR ESTIMATED PAYMENTS: complete Form 37EZ,

Sections A and B is no later than April 15 for ALL RITA

Form 37A, 37B or Form 37

MUNICIPALITIES.

FOR EXCESSIVE PAYROLL WITHHOLDINGS

(including tax withheld for a person under 18 years

of age): complete Form 10A

**** YOU CAN LET RITA CALCULATE YOUR

FOR FEDERAL FORM 2106, Employee Business

TAXES BY USING THE AUTO CALCULATE FORM 37 OR

Expenses: complete Form 10A

FILE YOUR RETURN USING E-FILE, BOTH ARE AVAIL-

* Note: refunds received from your work city may affect

ABLE AT PLEASE REVIEW THE

the tax due to your resident municipality. You may obtain

SEPARATE AUTO CALCULATE INSTRUCTIONS ON THE

forms at or by calling 440-526-0900 or

WEBSITE BEFORE STARTING ****

800-860-7482.

TAXABLE INCOME

An overpayment of estimated tax will be credited,

or if you choose, refunded by filing either a Form 37

You must report all of your income regardless of

Section A or Form 37 Sections A and B.

the income’s origin or characteristics including: wages,

salaries, commissions, stock options, severance pay,

EXTENSION TO FILE

other compensation including fees, sick pay, bonuses,

If you have a Federal extension beyond the

tips, rents and lottery/gambling winnings to the extent

August automatic extension date, a copy of that extension

they are taxable as provided by ordinance, profits/losses

must be received by RITA prior to 120 days after your

from businesses including professional associations,

original due date and all estimated liabilities, including cur-

partnerships, distributive shares representing compen-

rent year estimates, must be paid to date.

sation for Subchapter S corporations, royalties and

employer supplemental unemployment benefits (sub-

PENALTY AND INTEREST

pay). YOUR CONTRIBUTIONS TO RETIREMENT

In accordance with law, penalty and interest will

PLANS, ANNUITIES, DEFERRED COMPENSATION,

be charged for failure to file a return and to pay taxes,

401K OR INDIVIDUAL RETIREMENT ACCOUNTS ARE

including estimated taxes, when they are due.

TAXABLE WHETHER OR NOT YOUR W-2 FORM

SHOWS THIS INCOME AS TAXABLE.

If your estimated payments are not 90% of the tax

due, or are not equal to or greater than your prior year’s

total tax liability, you will be subject to penalty and interest

assessments.

Page 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22