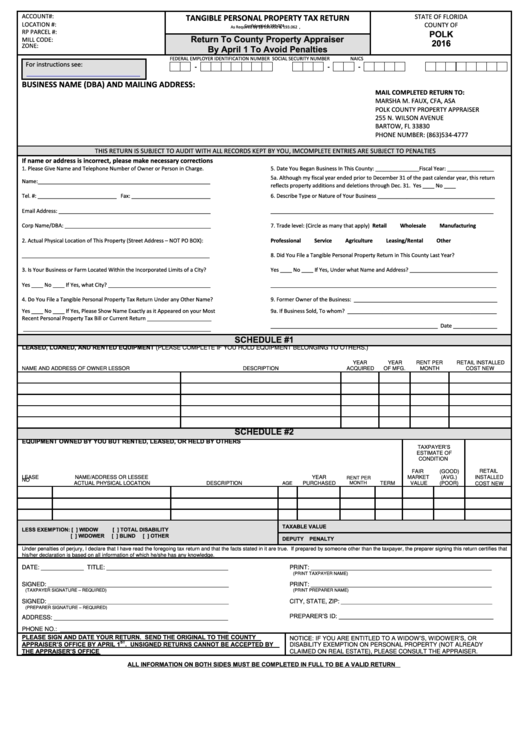

ACCOUNT#:

STATE OF FLORIDA

TANGIBLE PERSONAL PROPERTY TAX RETURN

LOCATION #:

COUNTY OF

Confidential § 193.074 F.S.

POLK

RP PARCEL #:

As Required by §§ 193.052 & 193.062 F.S.,

Return To County Property Appraiser

MILL CODE:

2016

By April 1 To Avoid Penalties

ZONE:

FEDERAL EMPLOYER IDENTIFICATION NUMBER

SOCIAL SECURITY NUMBER

NAICS

For instructions see:

-

-

-

BUSINESS NAME (DBA) AND MAILING ADDRESS:

MAIL COMPLETED RETURN TO:

MARSHA M. FAUX, CFA, ASA

POLK COUNTY PROPERTY APPRAISER

255 N. WILSON AVENUE

BARTOW, FL 33830

PHONE NUMBER: (863)534-4777

THIS RETURN IS SUBJECT TO AUDIT WITH ALL RECORDS KEPT BY YOU, IMCOMPLETE ENTRIES ARE SUBJECT TO PENALTIES

If name or address is incorrect, please make necessary corrections

1. Please Give Name and Telephone Number of Owner or Person in Charge.

5. Date You Began Business In This County: _______________ Fiscal Year: ________________

5a. Although my fiscal year ended prior to December 31 of the past calendar year, this return

Name:___________________________________________________________

reflects property additions and deletions through Dec. 31. Yes ____ No ____

Tel. #: ___________________________ Fax: ___________________________

6. Describe Type or Nature of Your Business ________________________________________

Email Address: ____________________________________________________

____________________________________________________________________________

Corp Name/DBA: __________________________________________________

7. Trade level: (Circle as many that apply) Retail

Wholesale

Manufacturing

2. Actual Physical Location of This Property (Street Address – NOT PO BOX):

Professional

Service

Agriculture

Leasing/Rental

Other

________________________________________________________________

8. Did You File a Tangible Personal Property Return in This County Last Year?

3. Is Your Business or Farm Located Within the Incorporated Limits of a City?

Yes ____ No ____ If Yes, Under what Name and Address? ______________________________

Yes ____ No ____ If Yes, what City? ___________________________________

_____________________________________________________________________________

4. Do You File a Tangible Personal Property Tax Return Under any Other Name?

9. Former Owner of the Business: _________________________________________________

Yes ____ No ____ If Yes, Please Show Name Exactly as it Appeared on your Most

9a. If Business Sold, To whom? ___________________________________________________

Recent Personal Property Tax Bill or Current Return ______________________

_________________________________________________________ Date _______________

________________________________________________________________

SCHEDULE #1

LEASED, LOANED, AND RENTED EQUIPMENT (PLEASE COMPLETE IF YOU HOLD EQUIPMENT BELONGING TO OTHERS.)

YEAR

YEAR

RENT PER

RETAIL INSTALLED

NAME AND ADDRESS OF OWNER LESSOR

DESCRIPTION

ACQUIRED

OF MFG.

MONTH

COST NEW

SCHEDULE #2

EQUIPMENT OWNED BY YOU BUT RENTED, LEASED, OR HELD BY OTHERS

TAXPAYER’S

ESTIMATE OF

CONDITION

FAIR

(GOOD)

RETAIL

LEASE

NAME/ADDRESS OR LESSEE

YEAR

MARKET

(AVG.)

INSTALLED

RENT PER

NO

ACTUAL PHYSICAL LOCATION

DESCRIPTION

AGE

PURCHASED

MONTH

TERM

VALUE

(POOR)

COST NEW

TAXABLE VALUE

LESS EXEMPTION: [ ] WIDOW

[ ] TOTAL DISABILITY

[ ] WIDOWER

[ ] BLIND

[ ] OTHER

DEPUTY

PENALTY

Under penalties of perjury, I declare that I have read the foregoing tax return and that the facts stated in it are true. If prepared by someone other than the taxpayer, the preparer signing this return certifies that

his/her declaration is based on all information of which he/she has any knowledge.

DATE: _____________ TITLE: _____________________________________

PRINT: _______________________________________________________

(PRINT TAXPAYER NAME)

SIGNED: _______________________________________________________

PRINT: _______________________________________________________

(TAXPAYER SIGNATURE – REQUIRED)

(PRINT PREPARER NAME)

SIGNED: _______________________________________________________

CITY, STATE, ZIP: ______________________________________________

(PREPARER SIGNATURE – REQUIRED)

PREPARER’S ID: _______________________________________________

ADDRESS: _____________________________________________________

PHONE NO.: ___________________________________________________

PLEASE SIGN AND DATE YOUR RETURN. SEND THE ORIGINAL TO THE COUNTY

NOTICE: IF YOU ARE ENTITLED TO A WIDOW’S, WIDOWER’S, OR

ST

APPRAISER’S OFFICE BY APRIL 1

. UNSIGNED RETURNS CANNOT BE ACCEPTED BY

DISABILITY EXEMPTION ON PERSONAL PROPERTY (NOT ALREADY

THE APPRAISER’S OFFICE

CLAIMED ON REAL ESTATE), PLEASE CONSULT THE APPRAISER.

ALL INFORMATION ON BOTH SIDES MUST BE COMPLETED IN FULL TO BE A VALID RETURN

1

1 2

2