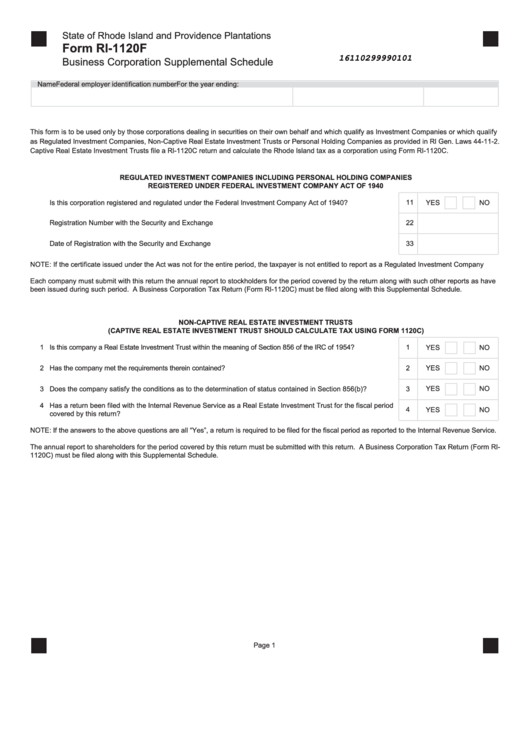

State of Rhode Island and Providence Plantations

Form RI-1120F

16110299990101

Business Corporation Supplemental Schedule

Name

Federal employer identification number

For the year ending:

This form is to be used only by those corporations dealing in securities on their own behalf and which qualify as Investment Companies or which qualify

as Regulated Investment Companies, Non-Captive Real Estate Investment Trusts or Personal Holding Companies as provided in RI Gen. Laws 44-11-2.

Captive Real Estate Investment Trusts file a RI-1120C return and calculate the Rhode Island tax as a corporation using Form RI-1120C.

REGULATED INVESTMENT COMPANIES INCLUDING PERSONAL HOLDING COMPANIES

REGISTERED UNDER FEDERAL INVESTMENT COMPANY ACT OF 1940

1

Is this corporation registered and regulated under the Federal Investment Company Act of 1940? ...........................

1

YES

NO

2

Registration Number with the Security and Exchange Commission............................................................................

2

Date of Registration with the Security and Exchange Commission .............................................................................

3

3

NOTE: If the certificate issued under the Act was not for the entire period, the taxpayer is not entitled to report as a Regulated Investment Company

Each company must submit with this return the annual report to stockholders for the period covered by the return along with such other reports as have

been issued during such period. A Business Corporation Tax Return (Form RI-1120C) must be filed along with this Supplemental Schedule.

NON-CAPTIVE REAL ESTATE INVESTMENT TRUSTS

(CAPTIVE REAL ESTATE INVESTMENT TRUST SHOULD CALCULATE TAX USING FORM 1120C)

Is this company a Real Estate Investment Trust within the meaning of Section 856 of the IRC of 1954? .........................

YES

NO

1

1

2

Has the company met the requirements therein contained? ...............................................................................................

2

YES

NO

Does the company satisfy the conditions as to the determination of status contained in Section 856(b)? .................

YES

NO

3

3

Has a return been filed with the Internal Revenue Service as a Real Estate Investment Trust for the fiscal period

4

YES

NO

4

covered by this return? ..............................................................................................................................................

NOTE: If the answers to the above questions are all “Yes”, a return is required to be filed for the fiscal period as reported to the Internal Revenue Service.

The annual report to shareholders for the period covered by this return must be submitted with this return. A Business Corporation Tax Return (Form RI-

1120C) must be filed along with this Supplemental Schedule.

Page 1

1

1 2

2 3

3