.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

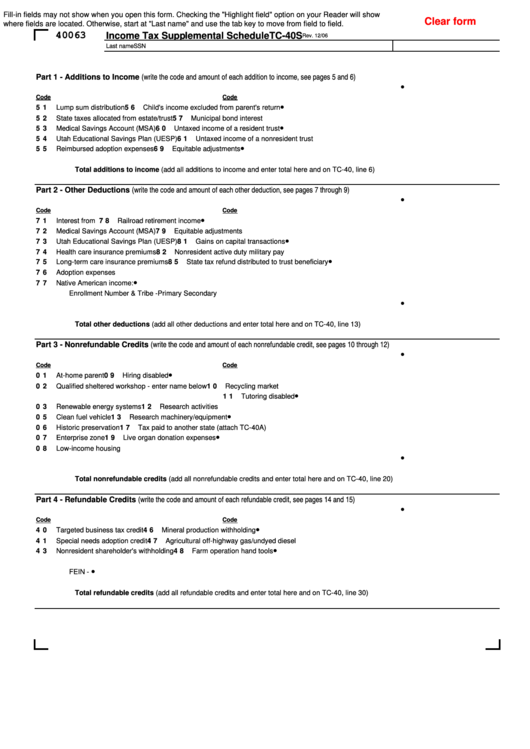

Fill-in fields may not show when you open this form. Checking the "Highlight field" option on your Reader will show

Clear form

where fields are located. Otherwise, start at "Last name" and use the tab key to move from field to field.

40063

Income Tax Supplemental Schedule

TC-40S

Rev. 12/06

Last name

SSN

Part 1 - Additions to Income (write the code and amount of each addition to income, see pages 5 and 6)

Code

Code

5 1

Lump sum distribution

5 6

Child's income excluded from parent's return

5 2

State taxes allocated from estate/trust

5 7

Municipal bond interest

5 3

Medical Savings Account (MSA)

6 0

Untaxed income of a resident trust

5 4

Utah Educational Savings Plan (UESP)

6 1

Untaxed income of a nonresident trust

5 5

Reimbursed adoption expenses

6 9

Equitable adjustments

Total additions to income (add all additions to income and enter total here and on TC-40, line 6)

Part 2 - Other Deductions (write the code and amount of each other deduction, see pages 7 through 9)

Code

Code

7 1

Interest from U.S. Government Obligations

7 8

Railroad retirement income

7 2

Medical Savings Account (MSA)

7 9

Equitable adjustments

Utah Educational Savings Plan (UESP)

Gains on capital transactions

7 3

8 1

7 4

Health care insurance premiums

8 2

Nonresident active duty military pay

7 5

Long-term care insurance premiums

8 5

State tax refund distributed to trust beneficiary

7 6

Adoption expenses

7 7

Native American income:

Enrollment Number & Tribe - Primary

Secondary

Total other deductions (add all other deductions and enter total here and on TC-40, line 13)

Part 3 - Nonrefundable Credits (write the code and amount of each nonrefundable credit, see pages 10 through 12)

Code

Code

0 1

At-home parent

0 9

Hiring disabled

0 2

Qualified sheltered workshop - enter name below

1 0

Recycling market

1 1

Tutoring disabled

0 3

Renewable energy systems

1 2

Research activities

0 5

Clean fuel vehicle

1 3

Research machinery/equipment

0 6

Historic preservation

1 7

Tax paid to another state (attach TC-40A)

0 7

Enterprise zone

1 9

Live organ donation expenses

0 8

Low-income housing

Total nonrefundable credits (add all nonrefundable credits and enter total here and on TC-40, line 20)

Part 4 - Refundable Credits (write the code and amount of each refundable credit, see pages 14 and 15)

Code

Code

4 0

Targeted business tax credit

4 6

Mineral production withholding

4 1

Special needs adoption credit

4 7

Agricultural off-highway gas/undyed diesel

4 3

Nonresident shareholder's withholding

4 8

Farm operation hand tools

FEIN -

Total refundable credits (add all refundable credits and enter total here and on TC-40, line 30)

1

1