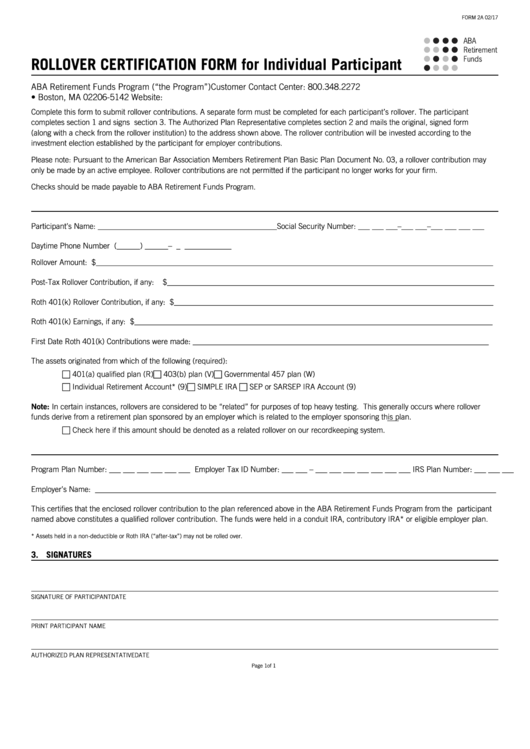

FORM 2A 02/17

ROLLOVER CERTIFICATION FORM for Individual Participant

ABA Retirement Funds Program (“the Program”)

Customer Contact Center: 800.348.2272

P.O. Box 5142 • Boston, MA 02206-5142

Website:

Complete this form to submit rollover contributions. A separate form must be completed for each participant’s rollover. The participant

completes section 1 and signs section 3. The Authorized Plan Representative completes section 2 and mails the original, signed form

(along with a check from the rollover institution) to the address shown above. The rollover contribution will be invested according to the

investment election established by the participant for employer contributions.

Please note: Pursuant to the American Bar Association Members Retirement Plan Basic Plan Document No. 03, a rollover contribution may

only be made by an active employee. Rollover contributions are not permitted if the participant no longer works for your firm.

Checks should be made payable to ABA Retirement Funds Program.

1. ROLLOVER INFORMATION

Participant’s Name: ______________________________________________ Social Security Number: ___ ___ ___–___ ___–___ ___ ___ ___

Daytime Phone Number ( ______ ) ______ – _____________

Rollover Amount: $ ______________________________________________________________________________________________________

Post-Tax Rollover Contribution, if any:

$____________________________________________________________________________________

Roth 401(k) Rollover Contribution, if any: $ __________________________________________________________________________________

Roth 401(k) Earnings, if any: $ ____________________________________________________________________________________________

First Date Roth 401(k) Contributions were made: ____________________________________________________________________________

The assets originated from which of the following (required):

401(a) qualified plan (R)

403(b) plan (V)

Governmental 457 plan (W)

Individual Retirement Account* (9)

SIMPLE IRA

SEP or SARSEP IRA Account (9)

Note In certain instances, rollovers are considered to be “related” for purposes of top heavy testing. This generally occurs where rollover

funds derive from a retirement plan sponsored by an employer which is related to the employer sponsoring this plan.

Check here if this amount should be denoted as a related rollover on our recordkeeping system.

2. EMPLOYER INFORMATION

Program Plan Number: ___ ___ ___ ___ ___ ___ Employer Tax ID Number: ___ ___ – ___ ___ ___ ___ ___ ___ ___ IRS Plan Number: ___ ___ ___

Employer’s Name: _______________________________________________________________________________________________________

This certifies that the enclosed rollover contribution to the plan referenced above in the ABA Retirement Funds Program from the participant

named above constitutes a qualified rollover contribution. The funds were held in a conduit IRA, contributory IRA* or eligible employer plan.

* Assets held in a non-deductible or Roth IRA (“after-tax”) may not be rolled over.

3. SIGNATURES

SIGNATURE OF PARTICIPANT

DATE

PRINT PARTICIPANT NAME

AUTHORIZED PLAN REPRESENTATIVE

DATE

Page 1 of 1

1

1