Recapture Tax Reimbursement Request Form

ADVERTISEMENT

R

T

R

R

ECAPTURE

AX

EIMBURSEMENT

EQUEST

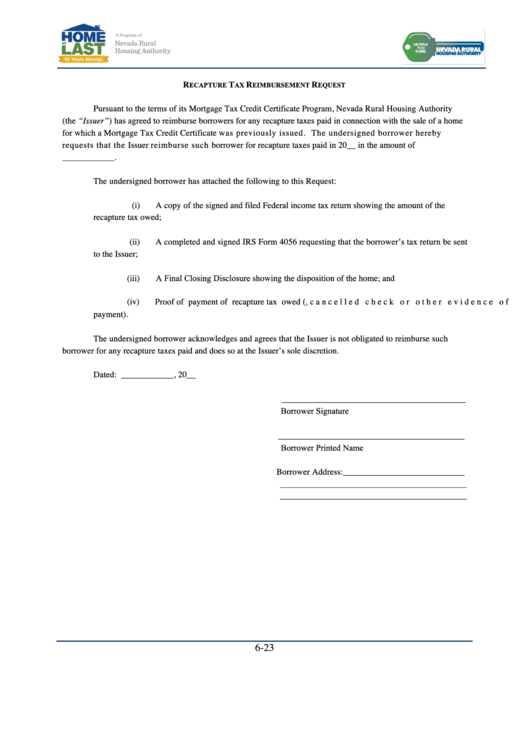

Pursuant to the terms of its Mortgage Tax Credit Certificate Program, Nevada Rural Housing Authority

(the “Issuer”) has agreed to reimburse borrowers for any recapture taxes paid in connection with the sale of a home

for which a Mortgage Tax Credit Certificate was previously issued.

The undersigned borrower hereby

requests that the Issuer reimburse such borrower for recapture taxes paid in 20__ in the amount of

____________.

The undersigned borrower has attached the following to this Request:

(i)

A copy of the signed and filed Federal income tax return showing the amount of the

recapture tax owed;

(ii)

A completed and signed IRS Form 4056 requesting that the borrower’s tax return be sent

to the Issuer;

A Final Closing Disclosure showing the disposition of the home; and

(iii)

(iv)

Proof of payment of recapture tax owed (i.e., cancelled check or other evidence of

payment).

The undersigned borrower acknowledges and agrees that the Issuer is not obligated to reimburse such

borrower for any recapture taxes paid and does so at the Issuer’s sole discretion.

Dated: ____________, 20__

___________________________________

Borrower Signature

___________________________________________

Borrower Printed Name

Borrower Address: ____________________________

___________________________________________

___________________________________________

6-23

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1