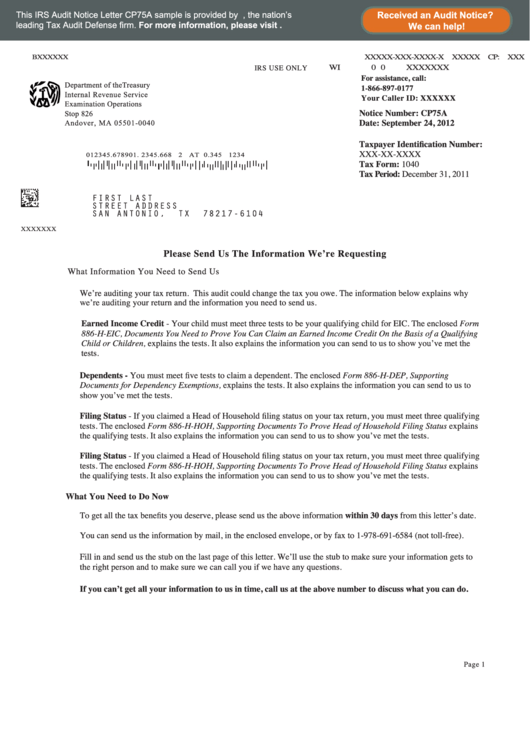

Irs Audit Letter Cp75a Sample

ADVERTISEMENT

This IRS Audit Notice Letter CP75A sample is provided by , the nation’s

Received an Audit Notice?

leading Tax Audit Defense firm. For more information, please visit .

We can help!

BXXXXXX

XXXXX-XXX-XXXX-X

XXXXX

CP:

XXX

XXXXX

WI

0 0

XX

IRS USE ONLY

For assistance, call:

Department of theTreasury

1-866-897-0177

Internal Revenue Service

Your Caller ID: XXXXXX

Examination Operations

Notice Number: CP75A

Stop 826

Date: September 24, 2012

Andover, MA 05501-0040

Taxpayer Identification Number:

XXX-XX-XXXX

012345.678901. 2345.668

2 AT 0.345

1234

Tax Form: 1040

Tax Period: December 31, 2011

FIRST LAST

STREET ADDRESS

SAN ANTONIO,

TX

78217-6104

XXXXXXX

Please Send Us The Information We’re Requesting

What Information You Need to Send Us

We’re auditing your tax return. This audit could change the tax you owe. The information below explains why

we’re auditing your return and the information you need to send us.

Earned Income Credit - Your child must meet three tests to be your qualifying child for EIC. The enclosed Form

886-H-EIC, Documents You Need to Prove You Can Claim an Earned Income Credit On the Basis of a Qualifying

Child or Children, explains the tests. It also explains the information you can send to us to show you’ve met the

tests.

Dependents - You must meet five tests to claim a dependent. The enclosed Form 886-H-DEP, Supporting

Documents for Dependency Exemptions, explains the tests. It also explains the information you can send to us to

show you’ve met the tests.

Filing Status - If you claimed a Head of Household filing status on your tax return, you must meet three qualifying

tests. The enclosed Form 886-H-HOH, Supporting Documents To Prove Head of Household Filing Status explains

the qualifying tests. It also explains the information you can send to us to show you’ve met the tests.

Filing Status - If you claimed a Head of Household filing status on your tax return, you must meet three qualifying

tests. The enclosed Form 886-H-HOH, Supporting Documents To Prove Head of Household Filing Status explains

the qualifying tests. It also explains the information you can send to us to show you’ve met the tests.

What You Need to Do Now

To get all the tax benefits you deserve, please send us the above information within 30 days from this letter’s date.

You can send us the information by mail, in the enclosed envelope, or by fax to 1-978-691-6584 (not toll-free).

Fill in and send us the stub on the last page of this letter. We’ll use the stub to make sure your information gets to

the right person and to make sure we can call you if we have any questions.

If you can’t get all your information to us in time, call us at the above number to discuss what you can do.

Page 1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Letters

1

1