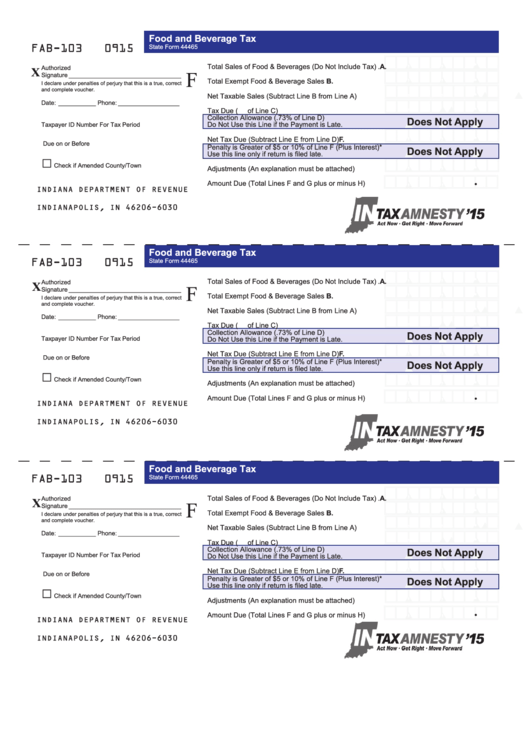

Fab-103 - Food And Beverage Tax

Download a blank fillable Fab-103 - Food And Beverage Tax in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Fab-103 - Food And Beverage Tax with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

Food and Beverage Tax

FAB-103

0915

State Form 44465

.

,

,

.

Total Sales of Food & Beverages (Do Not Include Tax) .A.

s

s

s

Authorized

F

,

,

Signature _________________________________

Total Exempt Food & Beverage Sales ........................... B.

.

s

s

s

I declare under penalties of perjury that this is a true, correct

,

,

and complete voucher.

.

Net Taxable Sales (Subtract Line B from Line A) ...........C.

s

s

s

,

,

Date: ___________ Phone: __________________

.

Tax Due (

of Line C)....................................................D.

s

s

s

,

,

Collection Allowance (.73% of Line D)

Does Not Apply

Do Not Use this Line if the Payment is Late. .................. E.

.

Taxpayer ID Number

For Tax Period

s

s

s

,

,

.

Net Tax Due (Subtract Line E from Line D) .....................F.

s

s

s

Due on or Before

,

,

Penalty is Greater of $5 or 10% of Line F (Plus Interest)*

Does Not Apply

.

□

Use this line only if return is filed late. ...........................G.

.

s

s

s

,

,

Check if Amended

County/Town

Adjustments (An explanation must be attached) ............H.

s

s

s

.

,

,

Amount Due (Total Lines F and G plus or minus H) ........ I.

s

s

INDIANA DEPARTMENT OF REVENUE

P.O. BOX 6030

INDIANAPOLIS, IN 46206-6030

Food and Beverage Tax

FAB-103

0915

State Form 44465

.

,

,

.

Total Sales of Food & Beverages (Do Not Include Tax) .A.

s

s

s

Authorized

F

,

,

Signature _________________________________

.

Total Exempt Food & Beverage Sales ........................... B.

s

s

s

I declare under penalties of perjury that this is a true, correct

,

,

and complete voucher.

.

Net Taxable Sales (Subtract Line B from Line A) ...........C.

s

s

s

,

,

Date: ___________ Phone: __________________

.

s

s

Tax Due (

of Line C)....................................................D.

s

,

,

Collection Allowance (.73% of Line D)

Does Not Apply

Do Not Use this Line if the Payment is Late. .................. E.

.

Taxpayer ID Number

For Tax Period

s

s

s

,

,

.

Net Tax Due (Subtract Line E from Line D) .....................F.

s

s

s

Due on or Before

,

,

Penalty is Greater of $5 or 10% of Line F (Plus Interest)*

Does Not Apply

.

□

Use this line only if return is filed late. ...........................G.

s

s

s

.

,

,

Check if Amended

County/Town

Adjustments (An explanation must be attached) ............H.

s

s

s

.

,

,

Amount Due (Total Lines F and G plus or minus H) ........ I.

s

s

INDIANA DEPARTMENT OF REVENUE

P.O. BOX 6030

INDIANAPOLIS, IN 46206-6030

Food and Beverage Tax

FAB-103

0915

State Form 44465

.

,

,

.

s

s

s

Total Sales of Food & Beverages (Do Not Include Tax) .A.

Authorized

F

,

,

Signature _________________________________

.

s

s

s

Total Exempt Food & Beverage Sales ........................... B.

I declare under penalties of perjury that this is a true, correct

,

,

and complete voucher.

.

s

s

s

Net Taxable Sales (Subtract Line B from Line A) ...........C.

,

,

Date: ___________ Phone: __________________

.

s

s

s

Tax Due (

of Line C)....................................................D.

,

,

Collection Allowance (.73% of Line D)

Does Not Apply

.

s

Taxpayer ID Number

For Tax Period

Do Not Use this Line if the Payment is Late. .................. E.

s

s

,

,

.

s

s

s

Net Tax Due (Subtract Line E from Line D) .....................F.

Due on or Before

,

,

Penalty is Greater of $5 or 10% of Line F (Plus Interest)*

Does Not Apply

.

□

s

s

s

.

Use this line only if return is filed late. ...........................G.

,

,

Check if Amended

County/Town

s

s

s

Adjustments (An explanation must be attached) ............H.

.

,

,

Amount Due (Total Lines F and G plus or minus H) ........ I.

s

s

INDIANA DEPARTMENT OF REVENUE

P.O. BOX 6030

INDIANAPOLIS, IN 46206-6030

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2