Clear Form

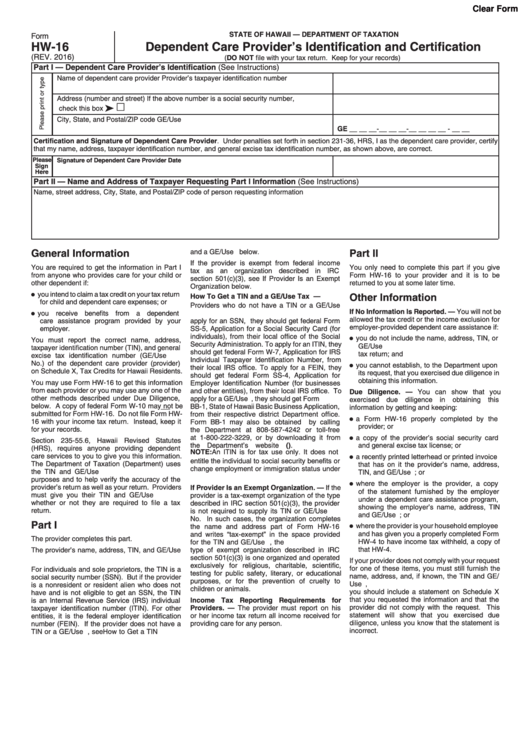

STATE OF HAWAII — DEPARTMENT OF TAXATION

Form

HW-16

Dependent Care Provider’s Identification and Certification

(DO NOT file with your tax return. Keep for your records)

(REV. 2016)

Part I — Dependent Care Provider’s Identification (See Instructions)

Name of dependent care provider

Provider’s taxpayer identification number

Address (number and street)

If the above number is a social security number,

£

ä

check this box

..............................................

City, State, and Postal/ZIP code

GE/Use I.D. No.

GE __ __ __-__ __ __-__ __ __ __ - __ __

Certification and Signature of Dependent Care Provider. Under penalties set forth in section 231-36, HRS, I as the dependent care provider, certify

that my name, address, taxpayer identification number, and general excise tax identification number, as shown above, are correct.

Please

Signature of Dependent Care Provider

Date

Sign

Here

Part II — Name and Address of Taxpayer Requesting Part I Information (See Instructions)

Name, street address, City, State, and Postal/ZIP code of person requesting information

General Information

Part II

and a GE/Use I.D. No. below.

If the provider is exempt from federal income

You are required to get the information in Part I

You only need to complete this part if you give

tax as an organization described in IRC

from anyone who provides care for your child or

Form HW-16 to your provider and it is to be

section 501(c)(3), see If Provider Is an Exempt

other dependent if:

returned to you at some later time.

Organization below.

•

Other Information

you intend to claim a tax credit on your tax return

How To Get a TIN and a GE/Use Tax I.D. No. —

for child and dependent care expenses; or

Providers who do not have a TIN or a GE/Use

If No Information Is Reported. — You will not be

•

I.D. No. should apply for one immediately. To

you receive benefits from a dependent

allowed the tax credit or the income exclusion for

apply for an SSN, they should get federal Form

care assistance program provided by your

employer-provided dependent care assistance if:

SS-5, Application for a Social Security Card (for

employer.

•

individuals), from their local office of the Social

you do not include the name, address, TIN, or

You must report the correct name, address,

Security Administration. To apply for an ITIN, they

GE/Use I.D. No. of the provider on your income

taxpayer identification number (TIN), and general

should get federal Form W-7, Application for IRS

tax return; and

excise tax identification number (GE/Use I.D.

Individual Taxpayer Identification Number, from

•

No.) of the dependent care provider (provider)

you cannot establish, to the Department upon

their local IRS office. To apply for a FEIN, they

on Schedule X, Tax Credits for Hawaii Residents.

its request, that you exercised due diligence in

should get federal Form SS-4, Application for

obtaining this information.

You may use Form HW-16 to get this information

Employer Identification Number (for businesses

from each provider or you may use any one of the

Due Diligence. — You can show that you

and other entities), from their local IRS office. To

other methods described under Due Diligence,

apply for a GE/Use I.D. No., they should get Form

exercised

due

diligence

in

obtaining

this

below. A copy of federal Form W-10 may not be

BB-1, State of Hawaii Basic Business Application,

information by getting and keeping:

submitted for Form HW-16. Do not file Form HW-

from their respective district Department office.

•

a Form HW-16 properly completed by the

16 with your income tax return. Instead, keep it

Form BB-1 may also be obtained

by calling

provider; or

for your records.

the Department at 808-587-4242 or toll-free

•

at 1-800-222-3229, or by downloading it from

a copy of the provider’s social security card

Section 235-55.6, Hawaii Revised Statutes

the Department’s website (tax.hawaii.gov).

and general excise tax license; or

(HRS), requires anyone providing dependent

NOTE: An ITIN is for tax use only. It does not

•

care services to you to give you this information.

a recently printed letterhead or printed invoice

entitle the individual to social security benefits or

The Department of Taxation (Department) uses

that has on it the provider’s name, address,

change employment or immigration status under

the TIN and GE/Use I.D. No. for identification

TIN, and GE/Use I.D. No.; or

U.S. law.

purposes and to help verify the accuracy of the

•

where the employer is the provider, a copy

If Provider Is an Exempt Organization. — If the

provider’s return as well as your return. Providers

of the statement furnished by the employer

must give you their TIN and GE/Use I.D. No.

provider is a tax-exempt organization of the type

under a dependent care assistance program,

whether or not they are required to file a tax

described in IRC section 501(c)(3), the provider

showing the employer’s name, address, TIN

return.

is not required to supply its TIN or GE/Use I.D.

and GE/Use I.D. No.; or

No. In such cases, the organization completes

Part I

•

where the provider is your household employee

the name and address part of Form HW-16

and has given you a properly completed Form

and writes “tax-exempt” in the space provided

The provider completes this part.

HW-4 to have income tax withheld, a copy of

for the TIN and GE/Use I.D. No.. Generally, the

that HW-4.

The provider’s name, address, TIN, and GE/Use

type of exempt organization described in IRC

I.D. No. should be entered in the spaces above.

section 501(c)(3) is one organized and operated

If your provider does not comply with your request

exclusively for religious, charitable, scientific,

for one of these items, you must still furnish the

For individuals and sole proprietors, the TIN is a

testing for public safety, literary, or educational

name, address, and, if known, the TIN and GE/

social security number (SSN). But if the provider

purposes, or for the prevention of cruelty to

Use I.D. No. of the provider on Schedule X. Also,

is a nonresident or resident alien who does not

children or animals.

you should include a statement on Schedule X

have and is not eligible to get an SSN, the TIN

Income Tax Reporting Requirements for

that you requested the information and that the

is an Internal Revenue Service (IRS) individual

Providers. — The provider must report on his

provider did not comply with the request. This

taxpayer identification number (ITIN). For other

statement will show that you exercised due

entities, it is the federal employer identification

or her income tax return all income received for

diligence, unless you know that the statement is

number (FEIN). If the provider does not have a

providing care for any person.

TIN or a GE/Use I.D. No., see How to Get a TIN

incorrect.

1

1