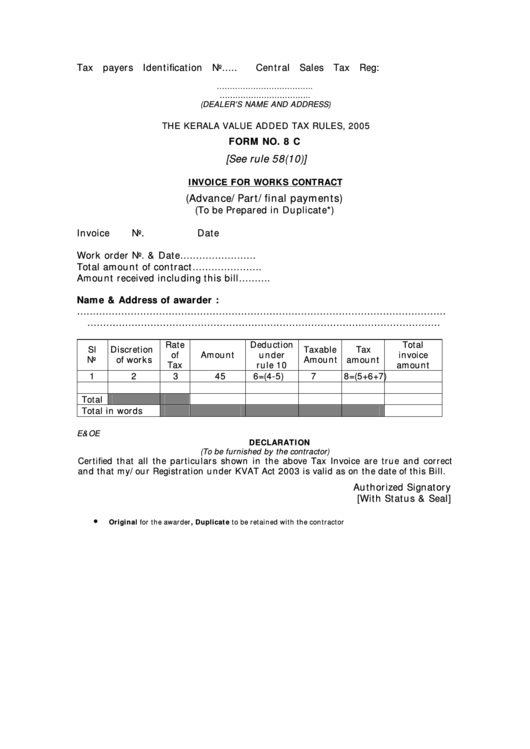

Form 8c - Invoice For Works Contract

ADVERTISEMENT

Tax payers Identification No…..

Central Sales Tax Reg:

……………………………….

……………………………..

(DEALER’S NAME AND ADDRESS)

THE KERALA VALUE ADDED TAX RULES, 2005

FORM NO. 8 C

[See rule 58(10)]

INVOICE FOR WORKS CONTRACT

(Advance/Part/final payments)

(To be Prepared in Duplicate*)

Invoice No.

Date

Work order No. & Date……………………

Total amount of contract………………….

Amount received including this bill……….

Name & Address of awarder :

………………………………………………………………………………………………………

…………………………………………………….……………………………………………

Rate

Deduction

Total

Sl

Discretion

Taxable

Tax

of

Amount

under

invoice

No

of works

Amount

amount

Tax

rule 10

amount

1

2

3

4

5

6=(4-5)

7

8=(5+6+7)

Total

Total in words

E&OE

DECLARATION

(To be furnished by the contractor)

Certified that all the particulars shown in the above Tax Invoice are true and correct

and that my/our Registration under KVAT Act 2003 is valid as on the date of this Bill.

Authorized Signatory

[With Status & Seal]

•

Original for the awarder , Duplicate to be retained with the contractor

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1