1040 - Individual Tax Return Engagement Letter Template

ADVERTISEMENT

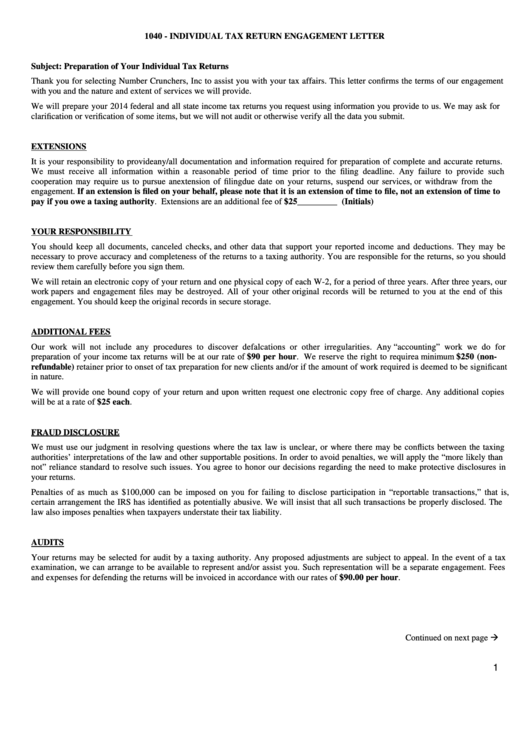

1040 - INDIVIDUAL TAX RETURN ENGAGEMENT LETTER

Subject: Preparation of Your Individual Tax Returns

Thank you for selecting Number Crunchers, Inc to assist you with your tax affairs. This letter confirms the terms of our engagement

with you and the nature and extent of services we will provide.

We will prepare your 2014 federal and all state income tax returns you request using information you provide to us. We may ask for

clarification or verification of some items, but we will not audit or otherwise verify all the data you submit.

EXTENSIONS

It is your responsibility to provide any/all documentation and information required for preparation of complete and accurate returns.

We must receive all information within a reasonable period of time prior to the filing deadline. Any failure to provide such

cooperation may require us to pursue an extension of filing due date on your returns, suspend our services, or withdraw from the

engagement. If an extension is filed on your behalf, please note that it is an extension of time to file, not an extension of time to

pay if you owe a taxing authority. Extensions are an additional fee of $25 _________ (Initials)

YOUR RESPONSIBILITY

You should keep all documents, canceled checks, and other data that support your reported income and deductions. They may be

necessary to prove accuracy and completeness of the returns to a taxing authority. You are responsible for the returns, so you should

review them carefully before you sign them.

We will retain an electronic copy of your return and one physical copy of each W-2, for a period of three years. After three years, our

work papers and engagement files may be destroyed. All of your other original records will be returned to you at the end of this

engagement. You should keep the original records in secure storage.

ADDITIONAL FEES

Our work will not include any procedures to discover defalcations or other irregularities. Any “accounting” work we do for

preparation of your income tax returns will be at our rate of $90 per hour. We reserve the right to require a minimum $250 (non-

refundable) retainer prior to onset of tax preparation for new clients and/or if the amount of work required is deemed to be significant

in nature.

We will provide one bound copy of your return and upon written request one electronic copy free of charge. Any additional copies

will be at a rate of $25 each.

FRAUD DISCLOSURE

We must use our judgment in resolving questions where the tax law is unclear, or where there may be conflicts between the taxing

authorities’ interpretations of the law and other supportable positions. In order to avoid penalties, we will apply the “more likely than

not” reliance standard to resolve such issues. You agree to honor our decisions regarding the need to make protective disclosures in

your returns.

Penalties of as much as $100,000 can be imposed on you for failing to disclose participation in “reportable transactions,” that is,

certain arrangement the IRS has identified as potentially abusive. We will insist that all such transactions be properly disclosed. The

law also imposes penalties when taxpayers understate their tax liability.

AUDITS

Your returns may be selected for audit by a taxing authority. Any proposed adjustments are subject to appeal. In the event of a tax

examination, we can arrange to be available to represent and/or assist you. Such representation will be a separate engagement. Fees

and expenses for defending the returns will be invoiced in accordance with our rates of $90.00 per hour.

Continued on next page

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Letters

1

1 2

2