Form 1120 - Corporation Tax Return Engagement Letter - 2016

ADVERTISEMENT

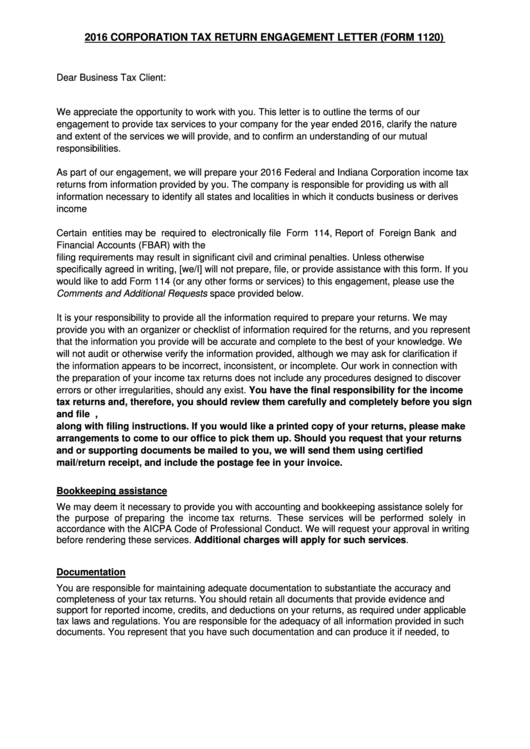

2016 CORPORATION TAX RETURN ENGAGEMENT LETTER (FORM 1120)

Dear Business Tax Client:

We appreciate the opportunity to work with you. This letter is to outline the terms of our

engagement to provide tax services to your company for the year ended 2016, clarify the nature

and extent of the services we will provide, and to confirm an understanding of our mutual

responsibilities.

As part of our engagement, we will prepare your 2016 Federal and Indiana Corporation income tax

returns from information provided by you. The company is responsible for providing us with all

information necessary to identify all states and localities in which it conducts business or derives

income

Certain entities may be required to electronically file Form 114, Report of Foreign Bank and

Financial Accounts (FBAR) with the U.S. Department of the Treasury. Failure to comply with the

filing requirements may result in significant civil and criminal penalties. Unless otherwise

specifically agreed in writing, [we/I] will not prepare, file, or provide assistance with this form. If you

would like to add Form 114 (or any other forms or services) to this engagement, please use the

Comments and Additional Requests space provided below.

It is your responsibility to provide all the information required to prepare your returns. We may

provide you with an organizer or checklist of information required for the returns, and you represent

that the information you provide will be accurate and complete to the best of your knowledge. We

will not audit or otherwise verify the information provided, although we may ask for clarification if

the information appears to be incorrect, inconsistent, or incomplete. Our work in connection with

the preparation of your income tax returns does not include any procedures designed to discover

errors or other irregularities, should any exist. You have the final responsibility for the income

tax returns and, therefore, you should review them carefully and completely before you sign

and file them. Completed returns will be sent to you via email in a password protected PDF,

along with filing instructions. If you would like a printed copy of your returns, please make

arrangements to come to our office to pick them up. Should you request that your returns

and or supporting documents be mailed to you, we will send them using certified

mail/return receipt, and include the postage fee in your invoice.

Bookkeeping assistance

We may deem it necessary to provide you with accounting and bookkeeping assistance solely for

the purpose of preparing the income tax returns. These services will be performed solely in

accordance with the AICPA Code of Professional Conduct. We will request your approval in writing

before rendering these services. Additional charges will apply for such services.

Documentation

You are responsible for maintaining adequate documentation to substantiate the accuracy and

completeness of your tax returns. You should retain all documents that provide evidence and

support for reported income, credits, and deductions on your returns, as required under applicable

tax laws and regulations. You are responsible for the adequacy of all information provided in such

documents. You represent that you have such documentation and can produce it if needed, to

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4