Farmers Tax Worksheet Template

Download a blank fillable Farmers Tax Worksheet Template in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Farmers Tax Worksheet Template with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

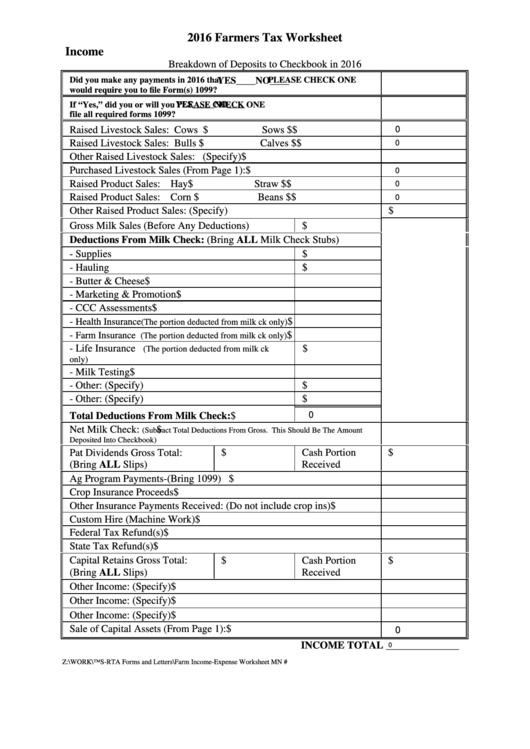

2016 Farmers Tax Worksheet

Income

Breakdown of Deposits to Checkbook in 2016

Did you make any payments in 2016 that

PLEASE CHECK ONE

YES____NO____

would require you to file Form(s) 1099?

If “Yes,” did you or will you

PLEASE CHECK ONE

YES_____NO____

file all required forms 1099?

0

Raised Livestock Sales: Cows $

Sows $

$

Raised Livestock Sales: Bulls $

Calves $

$

0

Other Raised Livestock Sales: (Specify)

$

Purchased Livestock Sales (From Page 1):

$

0

Raised Product Sales: Hay $

Straw $

$

0

Raised Product Sales: Corn $

Beans $

$

0

Other Raised Product Sales: (Specify)

$

Gross Milk Sales (Before Any Deductions)

$

Deductions From Milk Check:

(Bring ALL Milk Check Stubs)

- Supplies

$

- Hauling

$

- Butter & Cheese

$

- Marketing & Promotion

$

- CCC Assessments

$

-

$

Health Insurance

(The portion deducted from milk ck only)

-

$

Farm Insurance

(The portion deducted from milk ck only)

- Life Insurance

$

(The portion deducted from milk ck

only)

- Milk Testing

$

- Other: (Specify)

$

- Other: (Specify)

$

0

Total Deductions From Milk Check:

$

Net Milk Check:

$

(Subtract Total Deductions From Gross. This Should Be The Amount

Deposited Into Checkbook)

Pat Dividends Gross Total:

$

Cash Portion

$

(Bring ALL Slips)

Received

Ag Program Payments-(Bring 1099)

$

Crop Insurance Proceeds

$

Other Insurance Payments Received: (Do not include crop ins)

$

Custom Hire (Machine Work)

$

Federal Tax Refund(s)

$

State Tax Refund(s)

$

Capital Retains Gross Total:

$

Cash Portion

$

(Bring ALL Slips)

Received

Other Income: (Specify)

$

Other Income: (Specify)

$

Other Income: (Specify)

$

Sale of Capital Assets (From Page 1):

$

0

INCOME TOTAL ______________

0

Z:\WORK\TMS-RTA Forms and Letters\Farm Income-Expense Worksheet MN #134151.docx

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4