Form 2 08/16

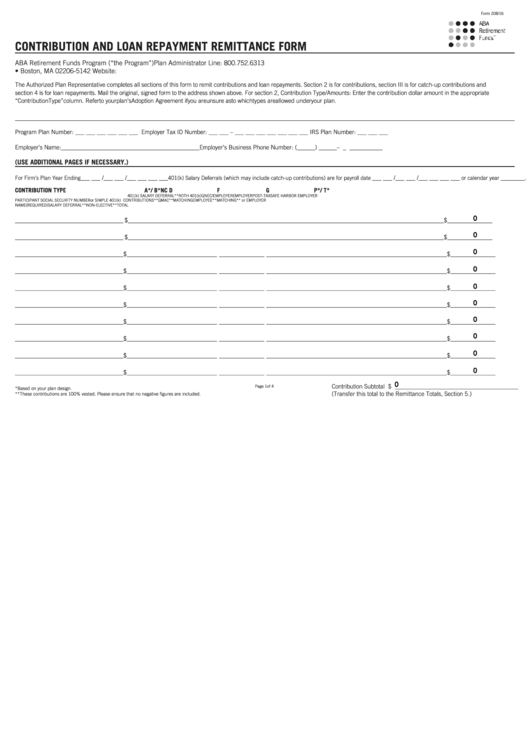

CONTRIBUTION AND LOAN REPAYMENT REMITTANCE FORM

ABA Retirement Funds Program (“the Program”)

Plan Administrator Line: 800.752.6313

P.O. Box 5142 • Boston, MA 02206-5142

Website:

The Authorized Plan Representative completes all sections of this form to remit contributions and loan repayments. Section 2 is for contributions, section III is for catch-up contributions and

section 4 is for loan repayments. Mail the original, signed form to the address shown above. For section 2, Contribution Type/Amounts: Enter the contribution dollar amount in the appropriate

“Contribution Type” column. Refer to your plan’s Adoption Agreement if you are unsure as to which types are allowed under your plan.

1. EMPLOYER INFORMATION

Program Plan Number: ___ ___ ___ ___ ___ ___ Employer Tax ID Number: ___ ___ – ___ ___ ___ ___ ___ ___ ___ IRS Plan Number: ___ ___ ___

Employer’s Name: ______________________________________________ Employer’s Business Phone Number: ( ______ ) ______ – ____________

2. CONTRIBUTION REMITTANCE (USE ADDITIONAL PAGES IF NECESSARY.)

___ ___ /___ ___ /___ ___ ___ ___

___ ___ /___ ___ /___ ___ ___ ___

________.

For Firm’s Plan Year Ending

401(k) Salary Deferrals (which may include catch-up contributions) are for payroll date

or calendar year

CONTRIBUTION TYPE

A* / B*

N

C

D

F

G

P*/ T*

401(k) SALARY DEFERRAL**

ROTH 401(k)

QNEC/

EMPLOYER

EMPLOYER

POST-TAX

SAFE HARBOR EMPLOYER

PARTICIPANT

SOCIAL SECURITY NUMBER

or SIMPLE 401(k)

CONTRIBUTIONS**

QMAC**

MATCHING

EMPLOYEE**

MATCHING** or EMPLOYER

NAME

(REQUIRED)

SALARY DEFERRAL**

NON-ELECTIVE**

TOTAL

__________________ __________________ $_______________ _______________ _______________ _______________ _______________ _______________ _______________ $_______________

__________________ __________________ $_______________ _______________ _______________ _______________ _______________ _______________ _______________ $_______________

__________________ __________________ $_______________ _______________ _______________ _______________ _______________ _______________ _______________ $_______________

__________________ __________________ $_______________ _______________ _______________ _______________ _______________ _______________ _______________ $_______________

__________________ __________________ $_______________ _______________ _______________ _______________ _______________ _______________ _______________ $_______________

__________________ __________________ $_______________ _______________ _______________ _______________ _______________ _______________ _______________ $_______________

__________________ __________________ $_______________ _______________ _______________ _______________ _______________ _______________ _______________ $_______________

__________________ __________________ $_______________ _______________ _______________ _______________ _______________ _______________ _______________ $_______________

__________________ __________________ $_______________ _______________ _______________ _______________ _______________ _______________ _______________ $_______________

__________________ __________________ $_______________ _______________ _______________ _______________ _______________ _______________ _______________ $_______________

Contribution Subtotal $ _________________________________________

Page 1 of 4

* Based on your plan design.

(Transfer this total to the Remittance Totals, Section 5.)

** These contributions are 100% vested. Please ensure that no negative figures are included.

1

1 2

2 3

3 4

4