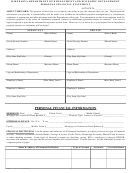

Sba Form 413 - Personal Financial Statement Page 3

ADVERTISEMENT

Instructions to Assist in Completing the

Personal Financial Statement (SBA Form 413)

for the CEED MicroLoan Program

Please do not make adjustments to your figures pursuant to U.S. Department of Transportation (U.S. DOT) regulations 49 CFR Part 26.

The agency that you apply to will use the information provided on your completed Personal Financial Statement to determine your

Personal Net Worth According to 49 CFR Part 26. An individual's Personal Net Worth According to 49 CFR Part 26 includes only his or

her own share of assets held jointly or as community property with the individual's spouse and excludes the following:

• Individual's ownership interest in the applicant firm;

• Individual's equity in his or her primary residence;

• Tax and interest penalties that would accrue if retirement savings or investments (e.g., pension plans, Individual

Retirement Accounts, 401(k) accounts, etc.) were distributed at the present time.

If your Personal Net Worth According to 49 CFR Part 26 exceeds the $750,000 cap and you, individually, or you and other

individuals are the majority owners of an applicant firm, the firm is not eligible for DBE certification. If the Personal Net Worth

According to 49 CFR Part 26 of the majority owner(s) exceeds the $750,000 cap at any time after your firm is certified, the firm

is no longer eligible for certification. Should that occur, it is your responsibility to contact your certifying agency in writing to

advise the firm no longer qualifies.

General Instructions

You must fill out all line items on the Personal Financial Statement (SBA Form 413) to the best of your ability.

On the form, above the Personal Financial Statement heading, indicate if financial information is for a “married couple” or “single

individual.”

On a separate sheet, identify all property that is not held jointly or as community property, and include values and ownership.

If necessary, use additional sheet(s) of paper to report all information and details.

If you have any questions about completing this form, please contact one of the certifying agencies on the Roster of Certifying

Agencies.

Specific Instructions

DATE AND CONTACT INFORMATION

Be sure to include the date in the upper right corner of the first page and your contact information.

ASSETS

All assets must be reported at their current fair market values as of the date of your statement. Assessor’s assessed value for real

estate, for example, is not acceptable. Assets held in a trust generally should be included.

Cash on hand & in Banks: Enter the total amount of cash on-hand and in bank accounts other than savings.

Savings Accounts: Enter the total amount in all savings accounts.

IRA or other Retirement Account: Enter the total present value of all IRAs and other retirement accounts, including any deferred

compensation and pension plans.

Accounts & Notes Receivable: Enter the total value of all monies owed to you personally, if any. This should include shareholder

loans to the applicant firm, if any.

Life Insurance-Cash Surrender Value Only: Enter the value of any life insurance polices. This amount should be cash surrender

value only, not the amount a beneficiary would receive upon your death, also known as face value. A complete description is required in

Section 8.

Stocks and Bonds: Enter the current market value of your stocks and bonds. A complete listing and description is required in Section 3.

Real Estate: Enter the current fair market value of all real estate owned. A complete listing and description of all real estate owned is

required in Section 4. The amount must correspond with the total “Present Market Value” amounts listed in Section 4.

Automobile-Present Value: Enter the current fair market value of all automobiles owned.

Other Personal Property: Enter the current fair market value of all other personal property owned, but not included in the previous

entries. A complete description of these assets is required in Section 5.

Other Assets: Enter the current fair market value of all other assets owned, but not included in the previous entries. A complete

description of these assets is required in Section 5.

LIABILITIES

Accounts Payable: Enter the total value of all unpaid accounts payable that is your responsibility.

Notes Payable to Bank and Others: Enter the total amount due on all notes payable to banks and others. This should not, however,

include any mortgage balances. A complete description of all notes payable to banks and others is required in Section 2.

Installment Account (Auto): Enter amount of the present balance of the debt that you owe for auto installment account. Please be

sure to indicate the total monthly payment in the space provided.

Installment Account (Other): Enter amount of the present balance of the debt that you owe for other installment account. Please be

sure to indicate the total monthly payment in the space provided. For example, include the balances of all credit card debts in this line.

Loans on Life Insurance: Enter the total value of all loans due on life insurance policies.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1 2

2 3

3 4

4